Marketing Communication. Capital at Risk. For Professional Investors Only.

Artificial intelligence could reshape the global economy—but behind the innovation lies a growing energy footprint. From training and running large-scale AI models to manufacturing chips and powering data centres, each stage of the AI lifecycle demands significant electricity. As AI capabilities expand and adoption accelerates, energy use is rising faster than infrastructure can keep up.1 With projections showing U.S. data centre electricity consumption tripling by 2028,2 and major hyperscalers committing hundreds of billions in AI investments,3 a new era of energy-intensive computing has arrived. This piece explores the scale, drivers, and infrastructure challenges of powering AI at today’s pace.

Key takeaways:

Training AI Models

Training AI models illustrates the power demands of AI. For example, training GPT-4 consumed approximately 50 gigawatt-hours (GWh) of electricity, enough to power 6,000 U.S. homes for a year, and fifty times the electricity used to train GPT-3.9 With the public release of GPT-4 in 2023, the need for larger GPU clusters has only grown.

The major hyperscalers could ramp up investments. Meta Platforms, for instance, has publicly stated that it plans to invest up to $80 billion in capital expenditure (capex) in 2025, and deploy 1.3 million GPUs.10 Meanwhile, xAI has publicly reported that it is aiming to expand its Colossus supercomputer to 1 million GPUs in the coming years.11 Microsoft has publicly reported that it plans to spend $80 billion on AI infrastructure in fiscal year 2025.12

Individual GPUs are also becoming more energy intensive. Nvidia’s Blackwell (GB200) chip, although significantly more power efficient, is designed for nearly seven times the power draw of the A100 chips used to train GPT-3.13 By 2028, U.S. data centres could account for between 325 and 580 TWh of total energy demand in the U.S., or 6.7% to 12.0% of the total U.S. electricity consumption forecasted for 2028.14

Using AI Applications

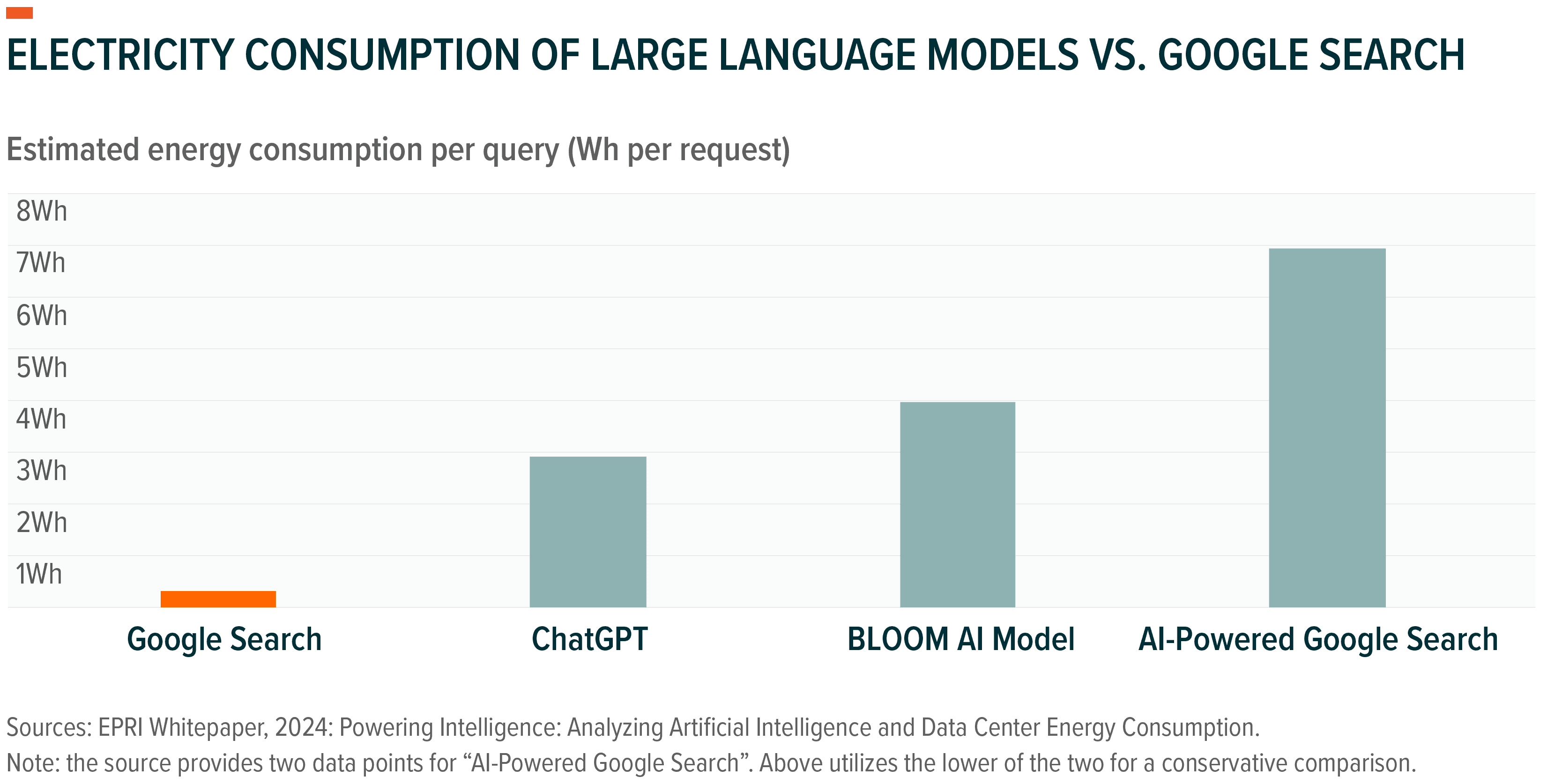

As AI models mature, the industry has shifted from training to inferencing, the process of applying trained models to generate outputs or predictions.15 The emergence of “reasoning” models are now consuming more resources than previous AI systems, and combined with greater model usage, has increased aggregate compute demand.16 For example, a ChatGPT query can consume 10 times more energy than a traditional Google Search,17 while more complex tasks, such as high-quality video generation or advanced imaging, can require hundreds of times more power.18

Looking ahead, the transition from simple inferencing to fully agentic AI could further accelerate energy demand. Agentic systems, capable of autonomous decision-making and multi-step reasoning, require vastly more computational resources.19 Nvidia CEO Jensen Huang, in his GTC 2025 keynote, stated that agentic AI workloads demand “easily 100 times more” compute than previously expected.20 Reflecting this anticipated surge, hyperscalers have committed over $300 billion in capital expenditures for 2025, primarily focused on AI infrastructure.21

Manufacturing AI Chips

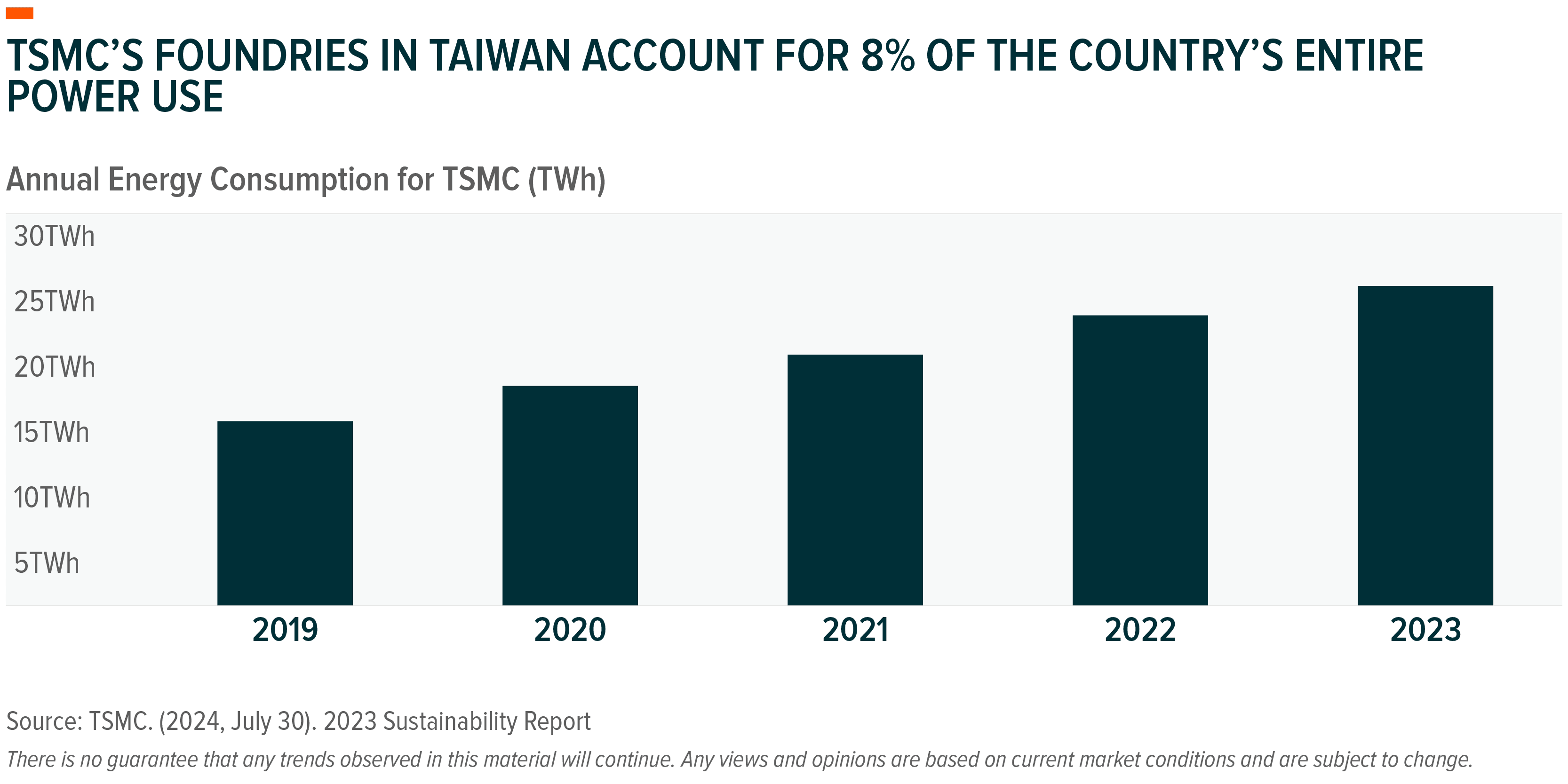

Semiconductor manufacturing is highly energy-intensive, driven by the need for precision and scale. Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest chipmaker, consumes 8% of Taiwan’s electricity, a figure that has been reported to potentially rise to 24% by 2030.22

As the U.S. reshores advanced chip production, energy demand could rapidly increase. The first phase of TSMC’s fab in Phoenix, Arizona, requires 200 megawatts (MW) of peak connected load, enough to power roughly 30,000 homes.23 The company recently publicly announced an additional $100 billion investment, expanding its U.S. footprint to six fabrication facilities (fabs).24 It is reported that each fab will carry substantial energy demands, especially as they produce smaller, more complex chips.25 With 73 semiconductor facilities planned or currently under construction,26 it is reported that the U.S. could produce 20% of the world’s most advanced chips by 2030,27 further amplifying the power needs of manufacturing.

DeepSeek and Data Centre Demand

Advancements in AI efficiency, such as DeepSeek’s r1 model announced earlier this year, could potentially add nuance to the energy consumption narrative. While DeepSeek claimed performance on par with leading U.S. AI models, with significantly lower computational cost and power requirements,28 historical patterns suggest that efficiency alone does not guarantee reduced total energy use. As economist William Stanley Jevons observed during the Industrial Revolution, gains in efficiency can paradoxically increase overall consumption,29 a dynamic now known as the Jevons Paradox. In this context, lower per-task costs can unlock broader adoption and new use cases, ultimately amplifying infrastructure demand.30 Notably, since DeepSeek’s announcement, Nvidia has continued to report record-breaking chip sales,31 and the ‘Big Four’ hyperscalers (Amazon, Meta, Alphabet, and Microsoft) reported year-on-year capex growth. U.S. data centre vacancy hit a record low of 2.6% at the end of 2024, with 6.6 gigawatts (GW) of capacity currently under construction, evidence that demand for computer and energy infrastructure potentially remains robust.32

Infrastructure Challenges

U.S. data centre electricity use is set to rise from 176 terra-watt hours (TWh) in 2023 to as high as 580TWh by 2028.33 To meet this surge, U.S. power producers may need to add roughly 50 gigawatts (GW) of new capacity by 2030.34 This challenge is compounded by rising power needs from semiconductor manufacturing and electric vehicle adoption, which could cost nearly $60 billion in new power generation investments.35

Between growing energy demand from data centres and rising supply from clean energy and battery storage, the ageing grid infrastructure in the U.S. may be a major roadblock. As of 2023, approximately 70% of transmission lines were over 25 years old, with much of the U.S. grid infrastructure built in the 1960s and 1970s.36 The average transformer is over 40 years old, and many transmission lines are operating beyond their capacity,37 potentially increasing the risk of failures, maintenance disruptions, and widespread outages.

Historically, utilities expanded generation and transmission capacity gradually, guided by long-term trends like population growth.38 Today, that approach may no longer be viable. Data centres can be built in under two years,39 often outpacing the grid’s ability to deliver sufficient, reliable power. Without a coordinated upgrade to the grid, the U.S. potentially risks a growing mismatch between digital infrastructure and the energy systems that power it.

This strain is intensified by the regional nature of data centre growth. In 2023, just 15 states accounted for 80% of all U.S. data centre energy use,40 with Virginia responsible for nearly 26%.41 This geographical concentration intensifies pressure on local grids, making targeted investments in substations, power redundancy, and fibre connectivity essential.

However, infrastructure development is not keeping pace. Building new high-voltage transmission lines often takes four years or more, driven by complex permitting and land access challenges.42 As of 2024, over 2,500 GW of generation and storage projects were waiting in interconnection queues nationwide,43 many of them tied to AI, cloud, and hyperscale data centre developments. Without accelerated upgrades to energy and connectivity infrastructure, regional data centre growth could risk being throttled by a lack of deliverable power.

While the U.S. has the most data centres globally,44 data centre capacity is also expanding rapidly in other markets. The EU’s €200 billion InvestAI initiative includes €20 billion earmarked for four AI gigafactories in Europe, each with 100,000 AI chips.45 This is in addition to seven AI factories announced in December 2024.46 As Europe and other regions strive to compete in AI infrastructure, global energy demand could increase significantly in parallel.

Tech Giants Invest in Nuclear Energy to Power AI and Data Centre Growth

Major technology companies are significantly investing in nuclear energy.47 The current operation of AI necessitates substantial energy consumption, and as large language models continue to grow in complexity, the forecast for power demand appears to increase.48 In 2022, data centres utilised approximately 460 TWh of power, as reported by the IEA. By 2026, the figure may exceed 1000 TWh, representing almost one-third of the total electricity produced by the world’s nuclear power plants last year, and approximately equivalent to Japan's electricity usage.49 For major technology companies, securing dominance in artificial intelligence is paramount; nevertheless, reconciling this objective with environmental preservation has proven challenging.50

With the rising global energy demands and the escalating significance of decarbonisation, there is potentially a compelling argument for nuclear energy as a pivotal component of the energy transition.51

The ambitious artificial intelligence projects of tech companies could fuel a renaissance in the nuclear power industry, which is attracting the attention of some of the world’s most prominent private wealth managers.52 Several big corporations demonstrated that nuclear power could be the way to go for sustainable energy in the long run.53 Major technology companies are not the sole entities aware of this possible trend; the global shift in market sentiment regarding nuclear energy, along with governmental actions endorsing this trend, may underscore its significance.54

Global Momentum for Nuclear Power Could Be Fuelled By AI and Innovation

Outcomes from COP29 have reinforced commitments to expand nuclear energy, with the U.S. pledging to increase nuclear power capacity by 35 gigawatts over the next decade and a tripling by 2050.55,56 With his rhetoric advocating for new nuclear reactors to help power energy-hungry data centres and manufacturing, the plan appears to maintain support under President Trump.57 There is bipartisan support on Capitol Hill for the nuclear industry and its possible revival, as underlined by the bipartisan legislation “Advance Act”, which stands for Advanced Nuclear for Clean Energy.58 In July, a law was enacted that gave the US Nuclear Regulatory Commission (‘the Commission’) new powers to oversee advanced reactors, license new fuels, and assess manufacturing breakthroughs that could lead to faster and cheaper buildouts.59

Rising AI demand could result in U.S. data centres consuming up to 12% of U.S. electricity by 2028.60 Against this backdrop, interest in small modular nuclear reactors appears to be growing around the world, and the United States is in discussions with multiple Southeast Asian states about deploying them.61

Small modular reactors can offer faster construction, lower costs, and reduced operational complexity compared to traditional nuclear reactors.62 Their compact size and modular design make them ideal for deployment in remote areas, potentially providing a more flexible and cost-effective energy solution.63

Even though Chinese AI language models appearing to be more efficient somehow could shift markets’ stance on US data centres’ power needs, the Trump administration’s nuclear drive is expected to maintain the pace and global nuclear power generation is projected to reach a record high this year.64,65 Indeed, in recent weeks, the top US nuclear regulator has been working to expedite the construction of power plants and simplify the approval process for new reactors.66

In Europe, electricity demand for data centres could triple by 2030.67 France, Finland, the Netherlands, and Sweden, among others, are calling on the European Commission to acknowledge the role of nuclear power in reducing carbon emissions across Europe.68

Conclusion: Increased Efficiency Can Lead to Increased Consumption

As artificial intelligence may revolutionise industries and drive innovation, its growing energy demands are posing significant challenges to existing infrastructure. The rapid expansion of AI technologies, particularly in data centres, will require unprecedented levels of electricity, raising concerns about the sustainability of current energy systems. With some projections showing a surge in energy consumption and the urgent need for grid upgrades, the future of AI development potentially hinges on finding scalable, reliable, and low carbon emissions energy solutions. The rise of nuclear power, especially through small modular reactors, presents a promising solution which could meet this demand. As governments and private investors recognise the critical role of nuclear energy, there is hope that this transformation will not only power AI but also pave the way for a more sustainable and energy-efficient future. As we navigate this new era of energy-intensive computing, collaboration and innovation will be key to ensuring that AI's potential is realised without compromising environmental sustainability.

1 Data Centre Magazine. (2024, November 12). Gartner: Power Shortages Could Limit 40% of AI Data Centres

2 Berkeley Lab, Energy Analysis & Environmental Impacts Division. (2024, December 19). 2024 United States Data Center Energy Usage Report.

3 Financial Times. (2025, February 7). Big Tech lines up over $300bn in AI spending for 2025

4 Berkeley Lab, Energy Analysis & Environmental Impacts Division. (2024, December 19). 2024 United States Data Center Energy Usage Report

5 NextEra. (2024, October 23). Third Quarter 2024 Earnings Conference Call. [Presentation].

6 U.S. Energy Information Administration. (2024, December 10). Short Term Energy Outlook.

7 The New York Times (16/10/2024) Hungry for Energy, Amazon, Google and Microsoft Turn to Nuclear Power

8 Strategy International (05/02/2025) Small Modular Reactors: Redefining Global Energy Security for a Digitalized Future

9 Forbes. (2024, May 23). AI Is Pushing The World Toward An Energy Crisis

10 TechCrunch. (2025, January 24). Mark Zuckerberg says Meta will have 1.3M GPUs for AI by year-end

11 Data Center Dynamics. (2024, December 4). xAI targets one million GPUs for the Colossus supercomputer in Memphis

12 CNBC. (2025, January 3). Microsoft expects to spend $80 billion on AI-enabled data centers in fiscal 2025

13 Fibermall. (2024, March 29). Analysis of NVIDIA’s Latest Hardware: B100/B200/GH200/NVL72/SuperPod

14 Berkeley Lab, Energy Analysis & Environmental Impacts Division. (2024, December 19). 2024 United States Data Center Energy Usage Report

15 Reuters. (2024, November 15). OpenAI and others seek new path to smarter AI as current methods hit limitations

16 Financial Times. (2025, March 11). How ‘inference’ is driving competition to Nvidia’s AI chip dominance

17 Bloomberg. (2024, December 13). AI Wants More Data. More Chips. More Real Estate. More Power. More Water. More Everything.

18 MIT Tech Review. (2024, May 23). AI is an energy hog. This is what it means for climate change.

19 Nvidia GTC. (2025). Nvidia GTC Keynote

20 Ibid

21 Business Insider. (2025, February 7). Tech Giants Are Lining up Over $300 Billion in AI Spend

22 Data Center Dynamics. (2024, October 7). TSMC could account for 24% of Taiwan’s electricity consumption by 2030

23 Arizona Technology Council. (2024). Utility company makes progress on infrastructure for Taiwan Semiconductor project in north Phoenix

24 TSMC. (2025, March 4). TSMC Intends to Expand Its Investment in the United States to US$165 Billion to Power the Future of AI

25 Reuters. (2025, January 10). TSMC begins producing 4-nanometer chips in Arizona, Raimondo says

26 Electronics360. (2024, March 25). Where new semiconductor fabs are being built

27 U.S. Department of Commerce. (2024, February 26). Remarks by U.S. Secretary of Commerce Gina Raimondo: Investing in Leading-Edge Technology: An Update on CHIPS Act Implementation

28 Financial Times. (2025, January 29). DeepSeek’s ‘aha moment’ creates new way to build powerful AI with less money

29 William Stanley Jevons. (1865) The Coal Question; An Inquiry Concerning The Progress of The Nation And The Probable Exhaustion of Our Coal-Mines

30 Fortune. (2025, January 27) Satya Nadella believes Chinese AI startup DeepSeek could be a win for tech, even as Microsoft’s shares tumble

31 Nvidia. (2025, February 26). NVIDIA Announces Financial Results for Fourth Quarter and Fiscal 2025

32 Jones Lang Lasalle. (2025). North American Data Center Report

33 Berkeley Lab, Energy Analysis & Environmental Impacts Division. (2024, December 19). 2024 United States Data Center Energy Usage Report.

34 S&P Insights. (2024, October 22). Data Centers: Surging Demand Will Benefit And Test The U.S. Power Sector.

35 Ibid.

36 U.S. Department of Energy (2023, October 19). What does it take to modernize the U.S. electric grid?

37 Niskanen Center. (2023, January 23). Powering the nation: how to fix the transformer shortage

38 U.S. Department of Energy (October 2023) National Transmission Needs Study

39 Green Mountain Data Centers. (2020, March 26). How long does it take to build a data center?

40 EPRI. (2024, May 5). Powering Intelligence

41 Ibid.

42 Jones Lang Lasalle. (2025). 2025 Global Data Center Outlook

43 Berkeley Lab, Energy Analysis & Environmental Impacts Division. (2024, December 19). 2024 United States Data Center Energy Usage Report

44 Statista. (March 2025). Leading countries by number of data centers as of March 2025

45 European Commission. (2025, February 11). EU launches InvestAI initiative to mobilise €200 billion of investment in artificial intelligence

46 European Commission. (2024, December 10). Seven consortia selected to establish AI factories which will boost AI innovation in the EU

47 The New York Times (2024, October 16) Hungry for Energy, Amazon, Google and Microsoft Turn to Nuclear Power

48 International Atomic Energy Agency, (2024, October). Data Centres, Artificial Intelligence and Cryptocurrencies Eye Advanced Nuclear to Meet Growing Power Needs

49 Ibid

50 Pifma (2024, March 28) AI and the Environment: A Double-Edged Sword for the Investment Industry

51 World Nuclear Association (2025, June 6) World Energy Needs and Nuclear Power

52 Bloomberg UK (2024, October 29) Private Equity’s Next Bet on Artificial Intelligence Is Nuclear Energy

53 Bloomberg UK (2024, October 16) Ken Griffin, Amazon Invest in Next-Generation Nuclear Energy

54 International Atomic Energy Agency (2024, November 18) Nuclear Power in the COP29 Spotlight as Countries and Companies Eye Climate Solutions

55 Ibid

56 Office of Nuclear Energy. (2024, November 12) U.S. Sets Targets to Triple Nuclear Energy Capacity by 2050

57 World Nuclear News (2025, February 18) US Council set up to advise President Trump on energy dominance

58 US Senate Committee on Environment & Public Works (2024, July 9) SIGNED: Bipartisan ADVANCE Act to Boost Nuclear Energy Now Law

59 Financial Post (2024, November 12) US Unveils Plan to Triple Nuclear Power By 2050 as Demand Soars

60 Berkeley Lab, Energy Analysis & Environmental Impacts Division. (2024, December 19). 2024 United States Data Center Energy Usage Report

61 Bloomberg UK (2024, October 22) US in Talks With Asian Nations to Deploy Small Nuclear Reactors

62 International Atomic Energy Agency (2023, September 13) What are Small Modular Reactors (SMRs)?

63 Ibid

64 Bloomberg (2025, 27 January) TSX-Listed Uranium Names Tumble on DeepSeek Buzz

65 Bloomberg (2025, February 6) IEA Sees Record Nuclear Production With Boost From Trump Plans

66 Bloomberg (2024, December 24) Sticking With US in Nuclear Power to Benefit Poland, Envoy Says

67 Reuters (2024, October 24) Europe's data centre power demand expected to triple by 2030, McKinsey report says

68 World Nuclear Association (2025, February 4) Nuclear Power in the European Union