From Bladerunner to The Matrix , the idea of artificial intelligence (AI) has long captivated popular culture and the public ’s imagination. Milestones like IBM’s Deep Blue in 1997 and Google Deepmind’s AlphaGo in 2016 demonstrated the ability of AI to surpass human performance in specific tasks. However, it was not until the public launch of ChatGPT in November 2022 that AI arguably captured mainstream global attention. ChatGPT quickly became the fastest app ever to reach 100 million users, achieving this milestone in just two months.1 This mainstream global attention could be said to have exemplified the emergence of AI as a megatrend, driven by record investment in its development and infrastructure.2 The Global X Artificial Intelligence UCITS ETF (AIQU LN) aims to capture companies that may stand to benefit from the potential growth and rapid commercialisation of AI.

Alan Turing, the British mathematician who deciphered the German Enigma code, famously asked the question “Can machines think?”3 AI is the concept of machines performing tasks once thought to require human intelligence. As the number of applications and forms of AI continue to expand, AI models can be classified into three levels to better understand its progress:

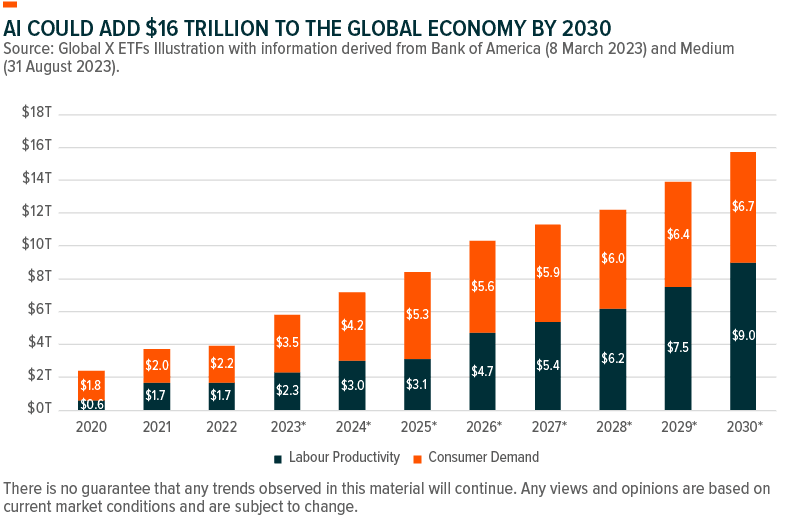

AI is poised to be a transformative technology, with the potential to reshape economies on a global scale. By 2030, AI has the potential to contribute $15.7 trillion to the global economy, a figure nearly on par with the European Union's entire GDP of $18.3 trillion in 2023.8 In addition, one report estimates that generative AI alone could contribute between $2.6 trillion and $4.4 trillion to the global economy annually.9 These projections highlight the potential for AI to unlock efficiencies across a wide range of sectors and companies, and drive growth in the global economy.

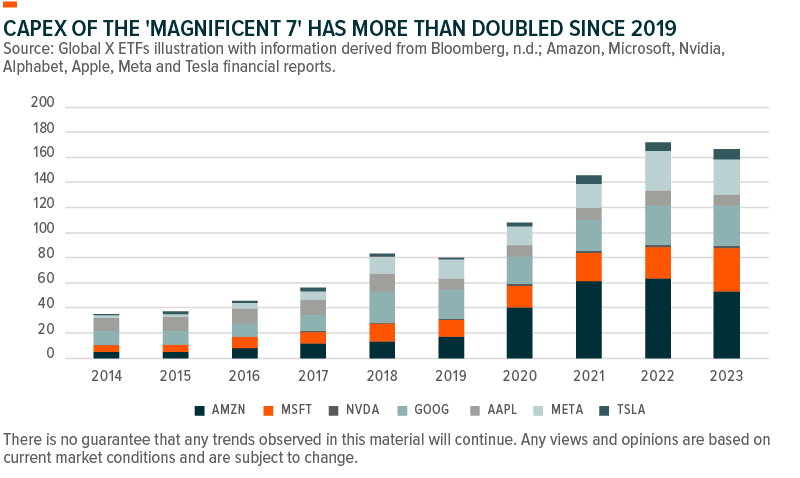

The spend on AI and AI-related infrastructure has increased significantly in the past few years and looks set to increase in the near term. A useful proxy for this is the growth in capital expenditure (capex) of the largest technology companies, the ‘Magnificent 7’, several of which house large hyperscaler businesses such as AWS (Amazon), Google Cloud (Alphabet) and Azure (Microsoft), or are investing heavily in AI infrastructure (Meta Platforms). Nvidia noted in its Q1 2024 earnings call that large cloud providers represented “the mid-40s” as a percentage of its Data Centre revenue.10 As seen in the chart below, Magnificent 7 capex has increased significantly in the past ten years, and especially in the past five years. Commentary from the Magnificent 7’s management has highlighted that a large portion of the increase in capex in the past few years is AI-related, and that this is expected to continue in the near term.11 In Alphabet’s Q2 2024 Earnings Call, CEO Sundar Pichai commented that the risk of underinvesting in AI was “dramatically greater” than the risk of overinvesting in it.12 In Meta Platform’s Q2 2024 results, CEO Mark Zuckerberg increased the lower end of FY24 capex guidance from $35 billion to $37 billion and stated that he expected “significant” capex growth in 2025.13

Who is driving the demand for AI computing power and infrastructure? In addition to their internal businesses, the Magnificent 7 are seeing demand for their AI capabilities from a variety of companies across a broad range of sectors.14 Three sectors expected to potentially benefit from AI are manufacturing, healthcare, and finance. These sectors are already experiencing significant transformations due to AI, with the range of applications expected to increase as described below:

AI sits at the intersection of several disruptive themes. As AI capabilities and computing power increase, a growing number of companies across some sectors are looking to integrate AI features and insights into their products . Companies involved in the AI value chain are well-positioned to potentially benefit from the growth of this theme. This value chain could include companies that own large proprietary data sets, are developing cutting-edge AI programs, or building the hardware and infrastructure capable of performing these complex computations.

These companies can be categorised into the following four key sub-categories:

Unsurprisingly, tech giants score well across most categories. Most of the Magnificent 7 companies have investments and/or exposures to two or three of the above categories.26 Many possess vast pools of proprietary data that can be used effectively to improve and monetise their offerings through AI, creating deep economic moats. As these companies refine their products, they collect even more data, and their AI becomes increasingly powerful.

Given their application of AI to their current offerings, most of the tech giants would be considered AI developers. In addition, there is a broader universe of companies that are harnessing AI capabilities to improve their offerings. Application vendors such as Adobe, Salesforce and ServiceNow have released AI features and functionalities to customers.27, 28, 29 As computing power and AI investment continues to increase, AI developers are expected to continue to improve their offerings.

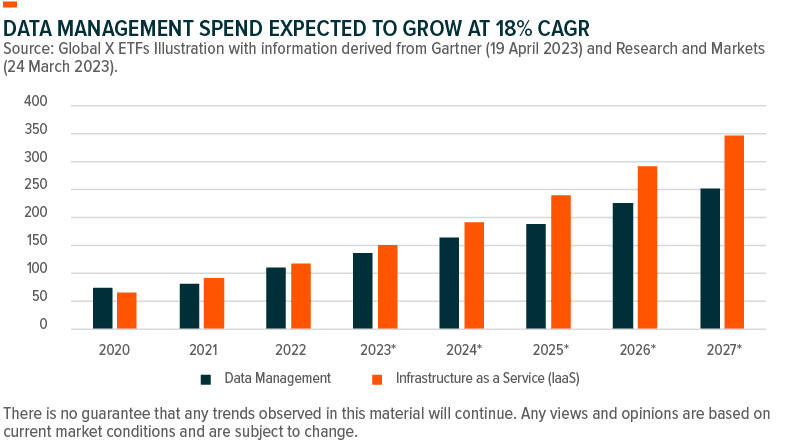

Cloud computing companies offering AI-as-a-Service to customers that bring their own data, are expanding the reach of AI to more sectors and customers. The increase in cloud computing demand is reflected in the forecast growth in data centre spending, which could reach almost US$600 billion by 2027.30, 31 Hyperscalers such as AWS, Azure and Google Cloud, are expected to play an important role in providing AI capabilities to their customers. For example, in Microsoft’s Q4 2024 earnings call, CEO Satya Nadella commented that 8% of the 29% growth in Azure and cloud services could be attributed to AI services and that it had over 60,000 Azure AI customers, representing almost 60% year-on-year growth.32 The growing demand for AI could spur future growth for cloud computing companies as they lower the cost of entry to AI, becoming the gateway to AI implementation.

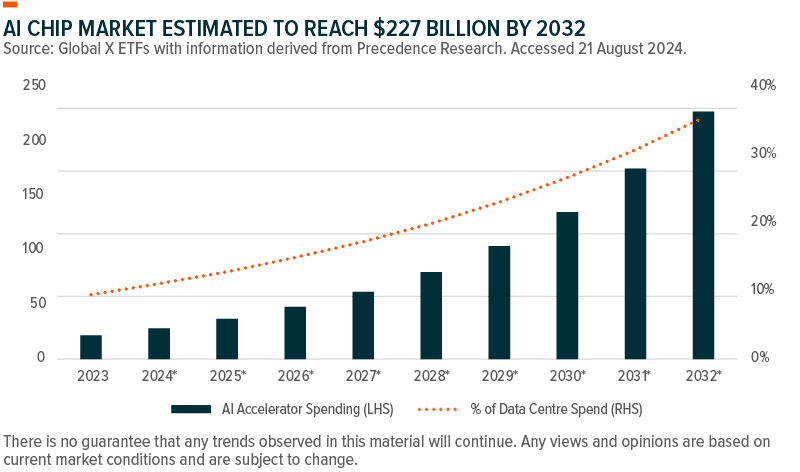

AI hardware firms, including companies developing cutting-edge processors, infrastructure and pioneering quantum computing, are considered essential to satisfy the growing computing demands for AI. Due to the growing size of training datasets and the number of parameters in AI models,33, 34 generative AI and deep learning models require significant amounts of computing power to perform training and inference on data. To meet the growing demand for AI computing power and handle AI workloads, new data centres require a diverse array of specialised hardware, potentially creating favourable conditions for component providers like Nvidia, Broadcom and SK Hynix. This is demonstrated by the significant growth of Nvidia’s GPU sales to data centres, which totalled nearly $66 billion in the twelve months leading up to March 2024.35 Demand for AI chips alone is estimated to grow at a nearly 30% annual growth rate to US$227 billion by 2032.36, 37

While the AI headlines have been dominated by the significant price appreciation of a few prominent companies, the broader AI ecosystem, though less well known, represents a valuable opportunity. By investing in companies exposed to one or more of the four groups discussed above, it is possible to capture the potential value that will be created by the wider AI theme. Furthermore, an investment approach unconstrained by sector or geography could enable us to better capture the breadth of the beneficiaries of the AI theme.

1 ChatGPT reaches 100 million users two months after launch, The Guardian. 3 February 2023.

2 Tech Giants Spend Billions on AI Startups – and Get Just as Much Back, Berber Jin and Tom Dotan, The Wall Street Journal. 3 November 2023.

3 Computing Machinery and Intelligence, A.M. Turing, Mind. October 1950.

4 Understanding the different types of artificial intelligence, IBM. 12 October 2023.

5 Ibid.

6 Hey Siri: An On-device DNN-powered Voice Trigger for Apple’s Personal Assistant, Apple. October 2017.

7 Untapped Value: What Every Executive Needs to Know About Unstructured Data, IDC. August 2023.

8 Sizing the prize: What’s the real value of AI for your business and how can you capitalize?, PWC. 2017.

9 The economic potential of generative AI: The next productivity frontier, McKinsey. June 2023.

10 Nvidia Q1 2025 Earnings Call, Bloomberg. 29 May 2024.

11 Amazon, Microsoft, Nvidia, Alphabet, Apple, Meta and Tesla financial reports, n.d.. Accessed 19 August 2024.

12 2024 Q2 Earnings Call, Alphabet Investor Relations. 23 July 2024.

13 Meta Platforms Second Quarter 2024 Results Conference Call, Meta Platforms. 31 July 2024.

14 Hyperscalers stress AI credentials, optimization and developer empowerment, S&P Global. Accessed 28 August 2024.

15 AI in Healthcare Market Size, Share & Trends Analysis Report By Component (Hardware, Services), By Application, By End-use, By Technology, By Region, And Segment Forecasts, 2024-2030, Grand View Research. 2024.

16 How Pfizer used AI and supercomputers to design COVID-19 vaccine, tablet, The Register. 22 March 2022.

17 Data Science & Artificial Intelligence: Unlocking new science insights, AstraZeneca. Accessed 21 August 2024.

18 How data and AI are helping unlock the secrets of disease, AstraZeneca. 1 November 2019.

19 Microsoft makes the promise of AI in healthcare real through new collaborations with healthcare organizations and partners, Microsoft. 11 March 2024.

20 The history of Amazon’s recommendation algorithm, Amazon Science. 22 November 2019.

21 Amazon Personalize, AWS. Accessed 21 August 2024.

22 Walmart Q2 2025 Earnings Call, Bloomberg. 15 August 2024.

23 The economic potential of generative AI: The next productivity frontier, McKinsey. June 2023.

24 Ibid.

25 Chairman and CEO Letter to Shareholders: Annual Report 2023, JPMorgan Chase. 8 April 2024.

26 Nvidia, Microsoft, Apple, Meta Platforms, Alphabet and Amazon company presentations and earnings call transcripts, n.d. Accessed 30 August 2024.

27 AI features, Adobe. Accessed 21 August 2024.

28 Put artificial intelligence to work with ServiceNow, ServiceNow. Accessed 21 August 2024.

29 Salesforce Artificial Intelligence, Salesforce. Accessed 21 August 2024.

30 Gartner Forecasts Worldwide Public Cloud End-user Spending to Reach Nearly $600 Billion in 2023, Gartner. 19 April 2023.

31 Global Data Management Software Market: Analysis by Type, by Organization Size, by Deployment Type, by Application, by Region Size & Forecast with Impact Analysis of Covid19 and Forecast up to 2028, Research and Markets. 24 March 2023.

32 Microsoft Q4 2024 Earnings Call, Bloomberg. 30 July 2024.

33 Parameters in notable artificial intelligence systems, Epoch AI with major processing by Our World in Data. 2024.

34 Trends in Training Dataset Sizes, Epoch AI. 20 September 2022.

35 NVIDIA QUARTERLY REVENUE TREND BY MARKETS, Nvidia Investor Relations. 22 May 2024.

36 Artificial Intelligence (AI) Chip Market Size, Share, and Trends 2024 to 2034, Precedence Research. Last Updated January 2023.

37 Data Center Market Size, Share, and Trends 2024 to 2034, Precedence Research. Last Updated July 2024.