Marketing Communication. Capital at Risk. For Professional Investors Only. Please read fund legal documentation before making any final investment decisions.

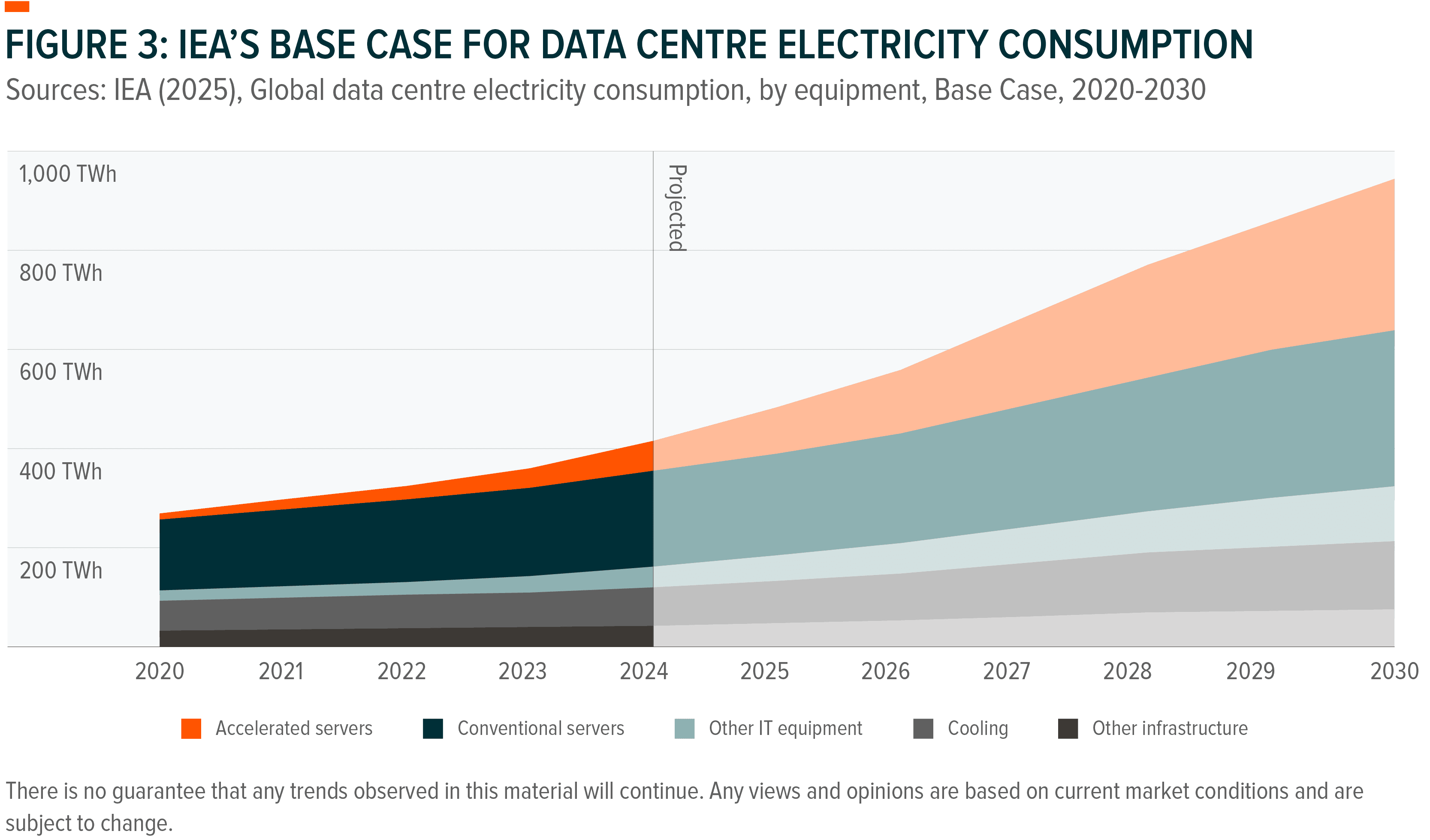

Copper demand has leaned on construction, autos and China’s infrastructure waves – sectors with meaningful GDP elasticity and cyclical exposure.1 Today, the centre of gravity is rotating toward AI/data-centre campuses, power grids, defence rearmament, EVs and fast-charging – programmes mapped years ahead by utilities, hyperscalers and governments, and therefore less sensitive to short-term cycles.2

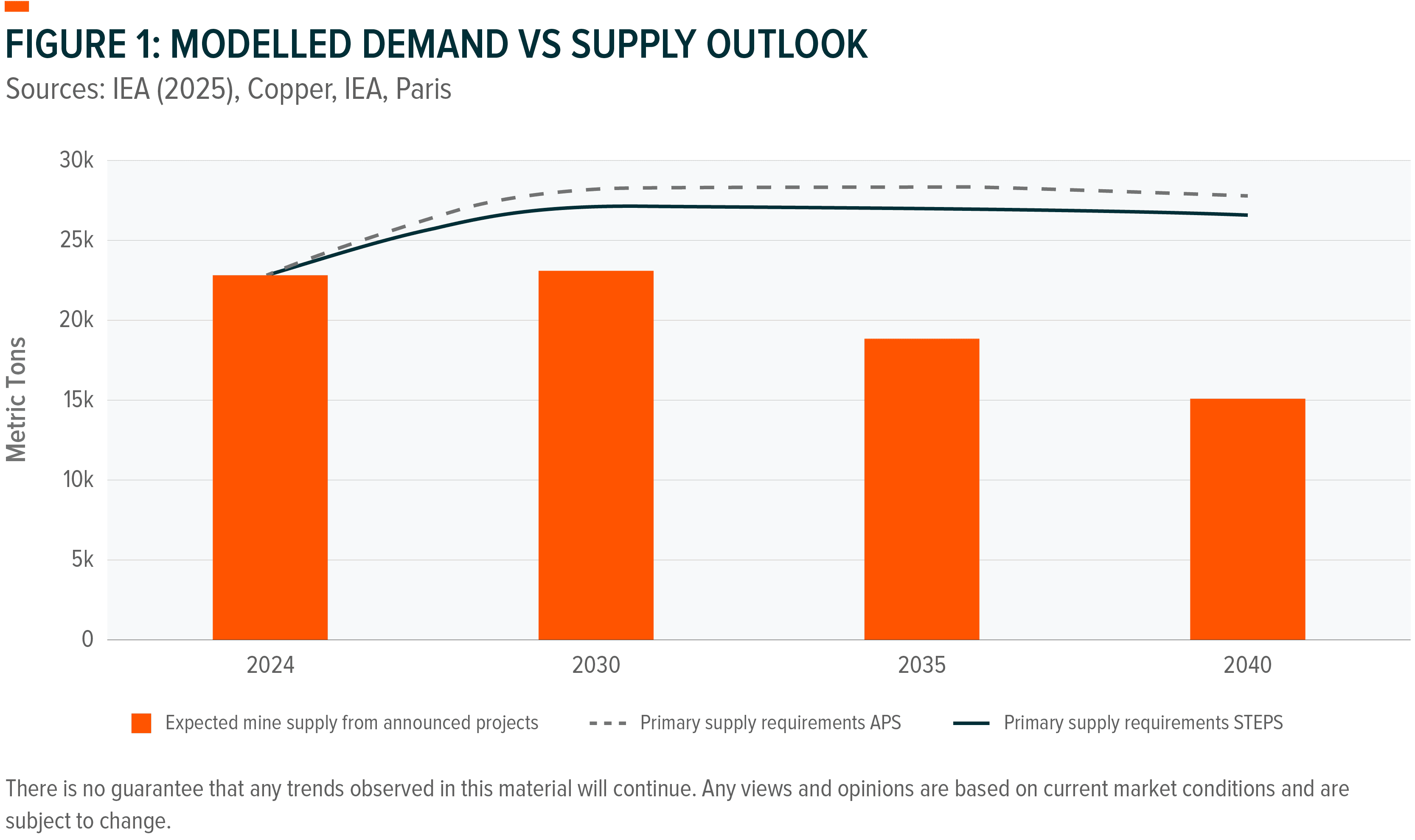

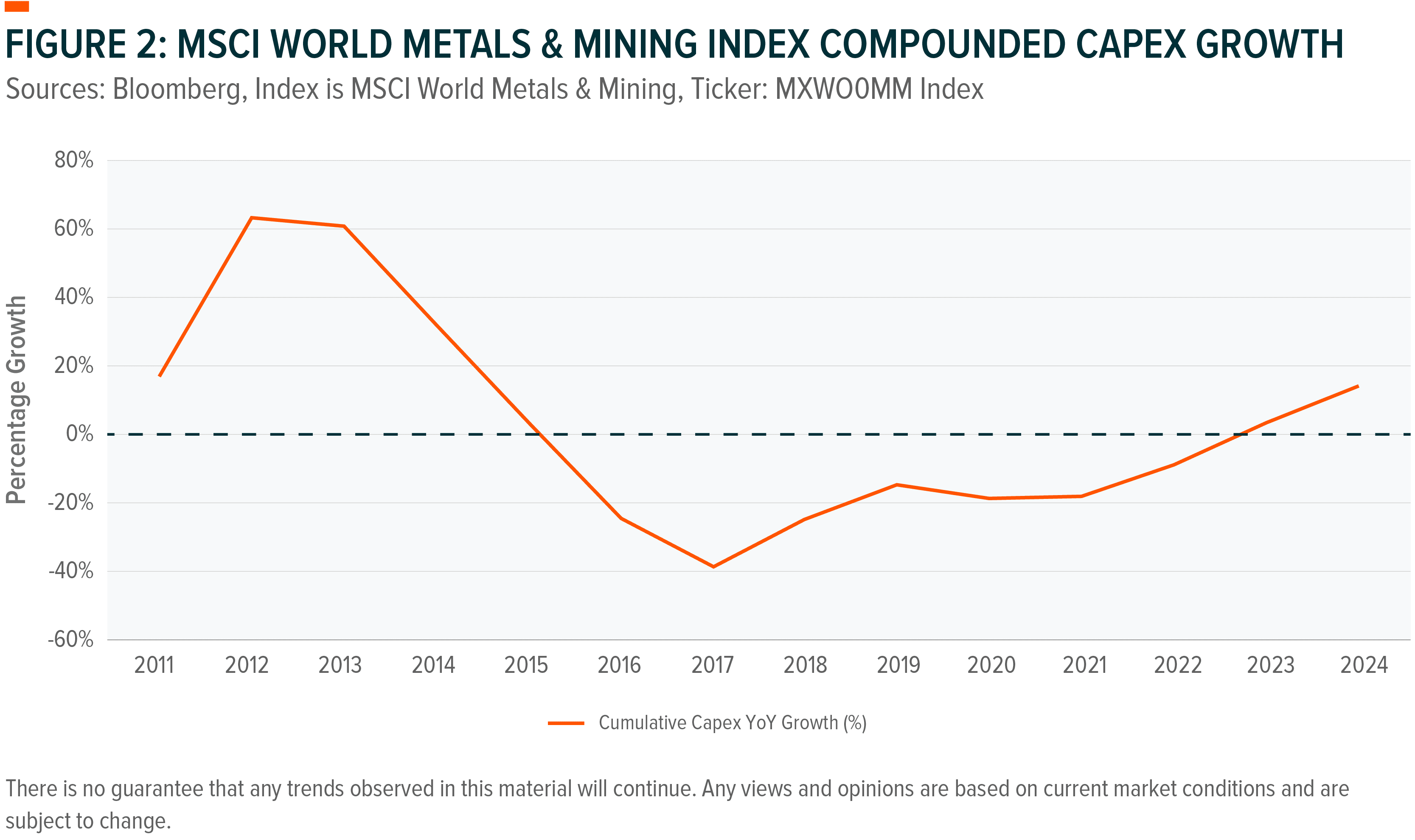

On the supply side, near-term refined balances look comfortable (despite some signs of tightness along the refinery chain), with forecasts of a surplus in 2025, but the forward-looking supply pipeline may give way to structural tightness as new mined output lags strong projections in demand.3 Announced mines meet only ~70% of primary supply needs by 2035, implying persistent tightness unless more projects, brownfield debottlenecks and recycling scale materialise.4 Meanwhile, diversified miners are pivoting towards copper via M&A and capital markets, potentially signalling a strategic bid for high-quality copper optionality.5,6,7

As this tightening supply outlook meets surging physical demand, copper is emerging as not just a beneficiary of the AI buildout, but as a potential constraint – the critical material that could govern its speed and scale.

Why demand growth is “real economy” and sticky

Persistence of Demand

DC campuses are planned, permitted and power-contracted on multi-year arcs; grid equipment and cable lead times have lengthened, reducing cyclicality.11

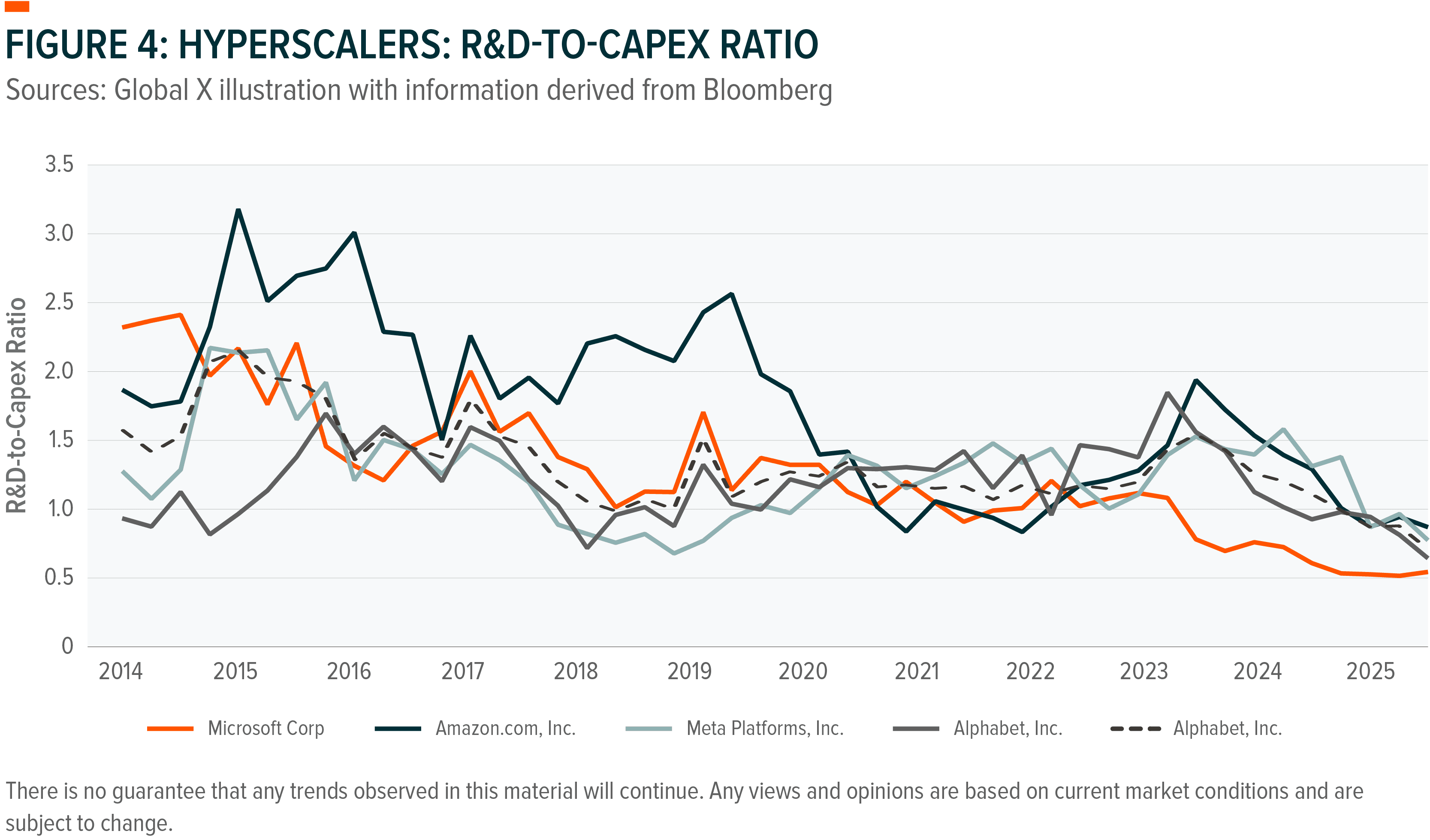

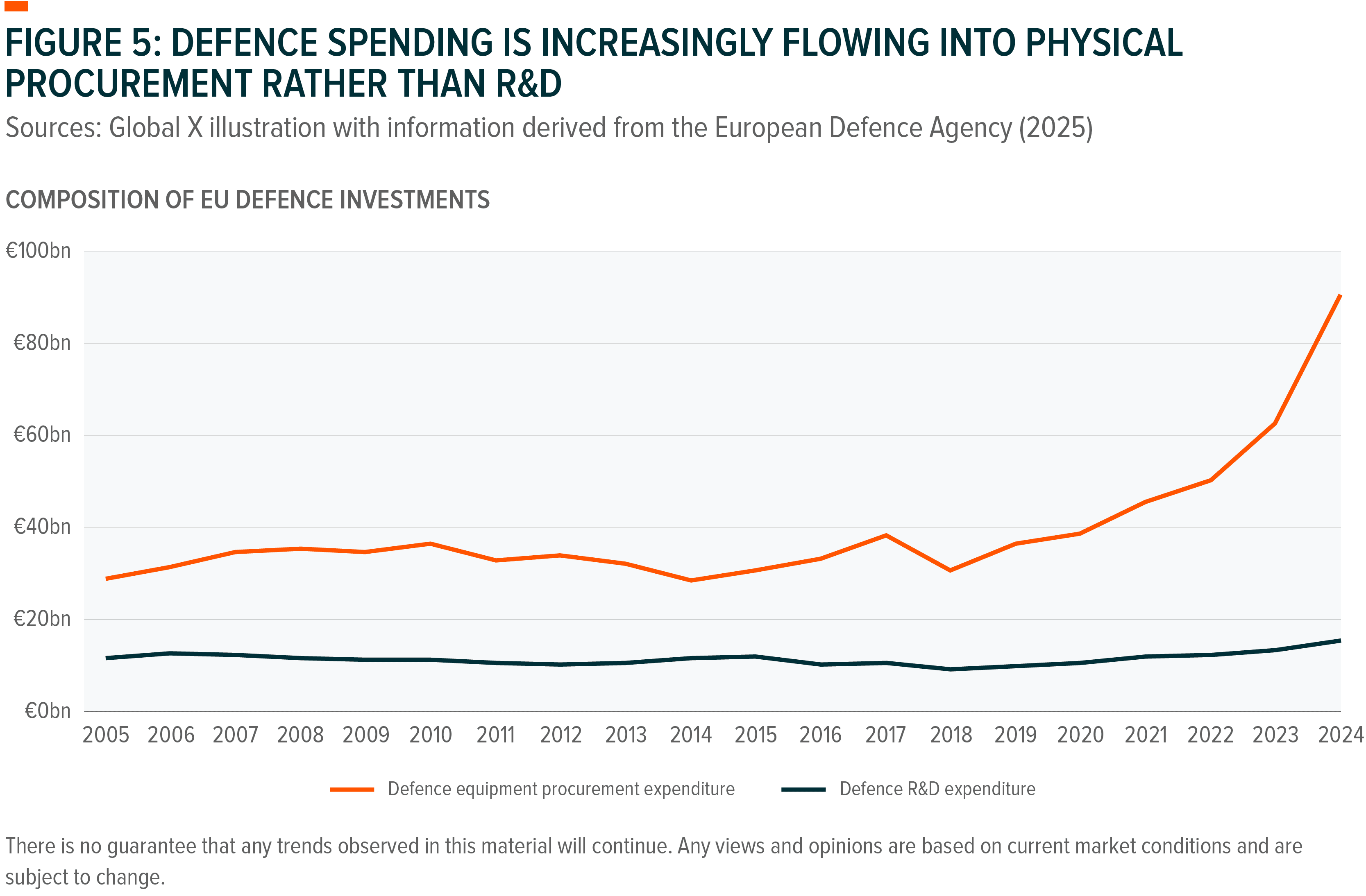

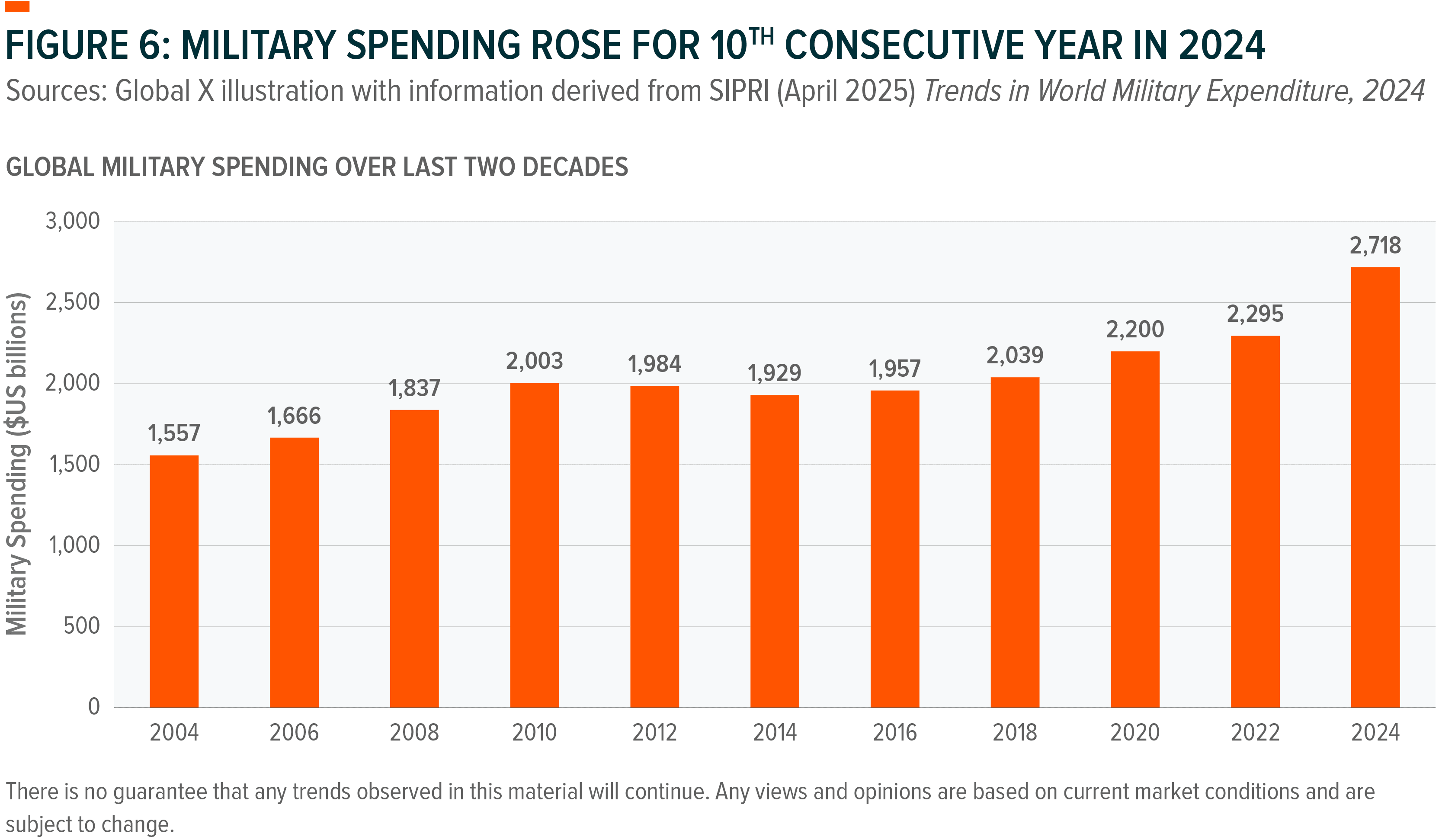

Structurally Higher Spending, with an Emphasis on Procurement over R&D

Persistence of Demand

Rearmament is policy-driven and multi-year; once appropriated and contracted, spend tends to execute through cycles.15

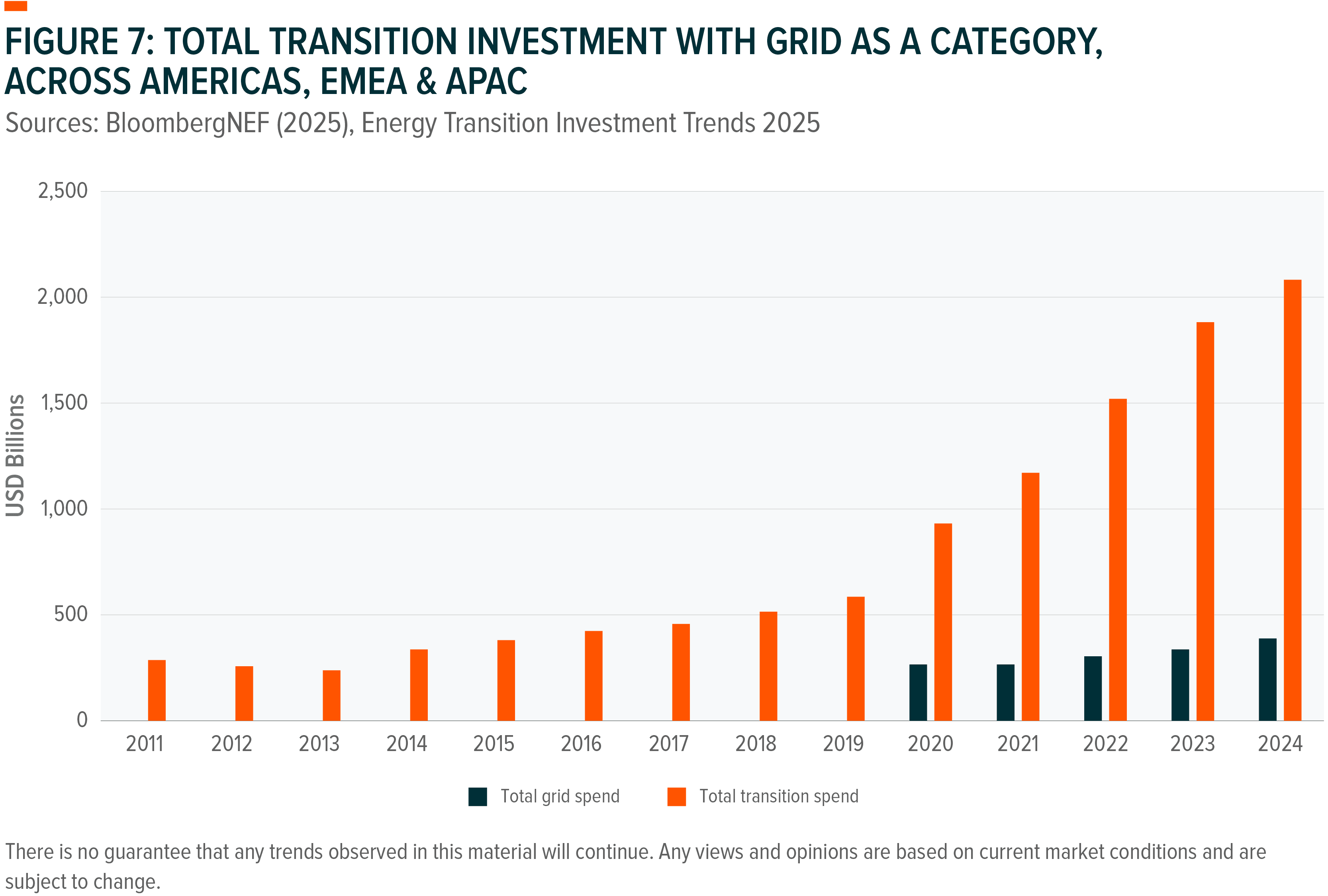

Investment in Grids is Stepping up and Copper Intensive

Persistence of Demand

Regulated utilities build to mandated reliability and connection targets; once procurement starts, packages typically run to completion.20

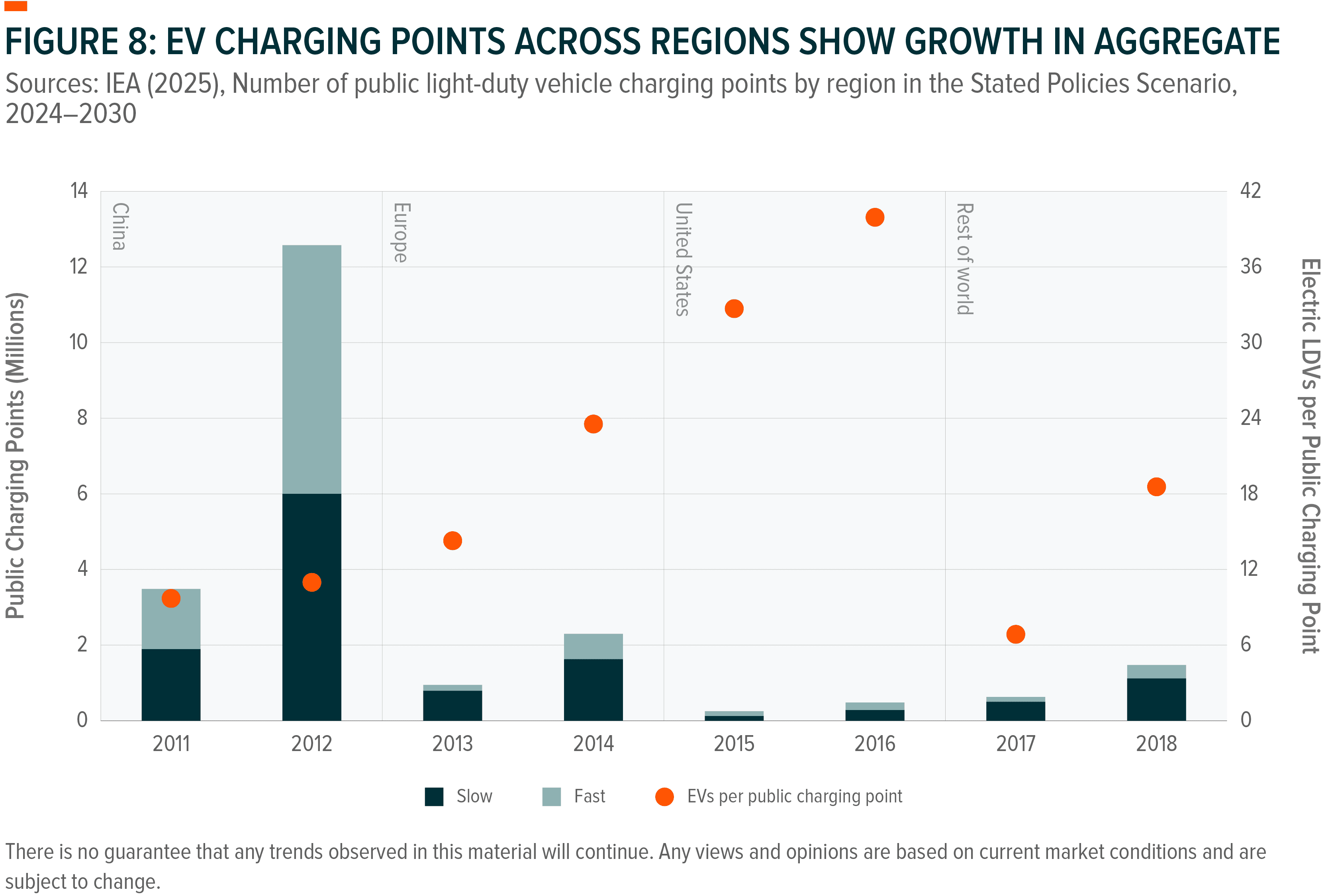

Transition to EVs and Fast-Charging Uses Incrementally More Copper

Persistence of Demand

National network targets and OEM model pipelines shape a steady cadence of chargers and copper-heavy power upgrades.24

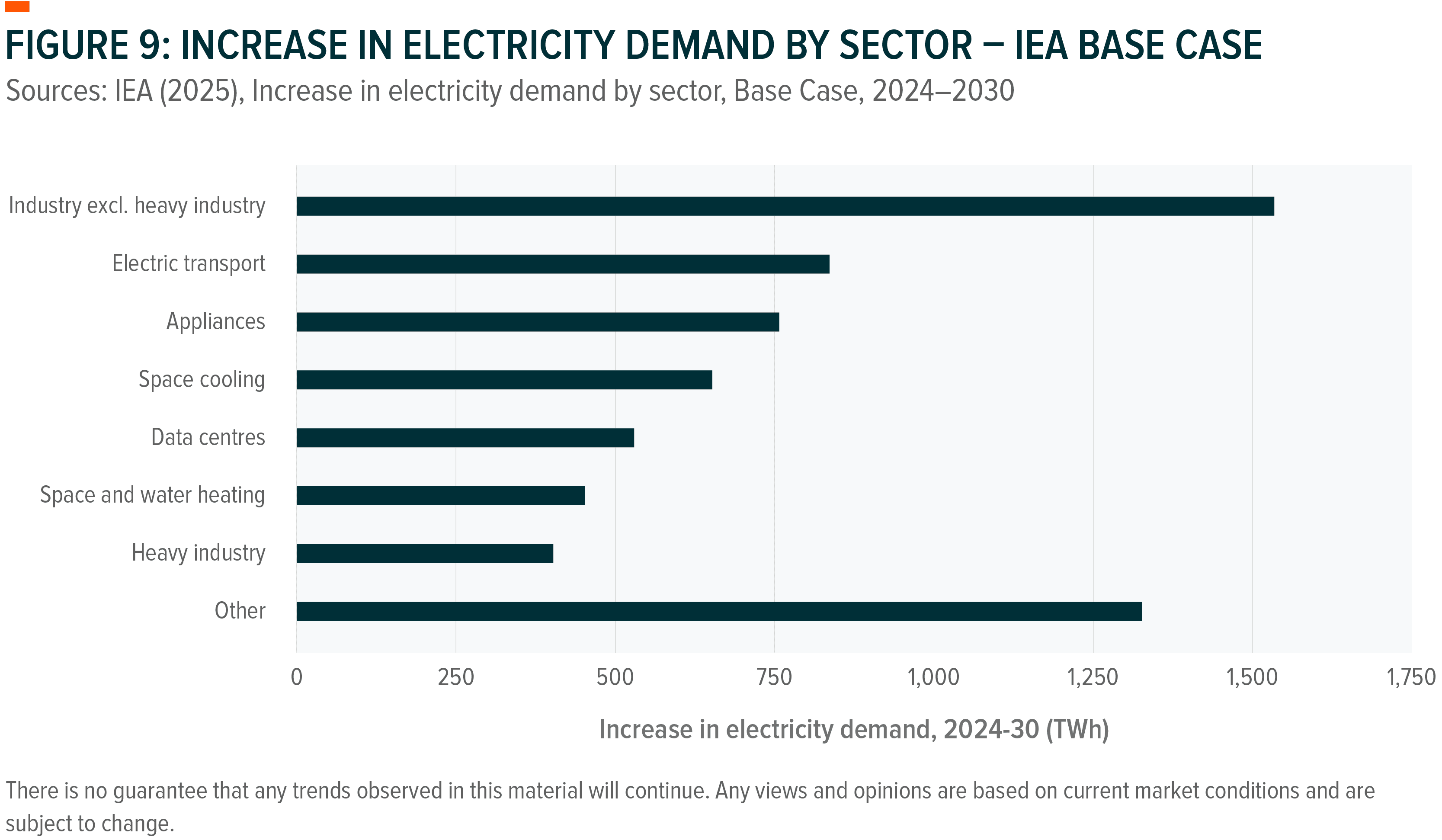

Industrial Electrification Continues, and Requires More Power

Persistence of Demand

Regulatory ratchets and corporate energy-cost logic underpin steady retrofit cycles rather than stop-start spending.28

1 International Copper Study Group (2025) World Copper Factbook 2024

2 International Energy Agency (IEA) (10/04/2025) AI is set to drive surging electricity demand from data centres while offering the potential to transform how the energy sector works

3 Shanghai Metal Market (29/04/2025) ICSG: Global copper cathode market is expected to see a surplus of 289,000 mt and 209,000 mt this year and next year, respectively.

4 International Energy Agency (IEA) (2025) Overview of outlook for key minerals

5 AngloAmerican (09/09/2025) Anglo American and Teck to combine through a merger of equals to form a global critical minerals champion

6 BHP (02/05/2023) Completion of OZ Minerals acquisition

7 Wood Mackenzie (02/04/2025) Copper production to become a growth driver in 2025 as capital allocation strategies diverge in mining

8 Ibid

9 Dell’Oro Group (06/07/2025) Data Center Capex to Grow at 21 Percent CAGR Through 2029, According to Dell’Oro Group

10 Synergy Research Group (19/03/2025) Hyperscale Data Center Count Hits 1,136; Average Size Increases; US Accounts for 54% of Total Capacity

11 International Energy Agency (2025) Invest in grids today or face gridlock tomorrow

12 NATO (25/06/2025) The Hague Summit Declaration

13 Reuters (27/08/2025) All NATO members hit old spending target, only three meet new goal

14 European Commission (15/03/2024) ASAP Results Factsheet

15 Ibid

16 BloombergNEG (30/01/2025) Energy Transition Investment Trends 2025

17 Ibid

18 Ibid

19 Reuters (31/07/2025) Global power grid expansion fuels fresh copper demand surge

20 Ibid

21 Ibid

22 Ibid

23 Federal Register (13/08/2025) National Electric Vehicle Infrastructure Formula Program Guidance

24 Ibid

25 Ibid

26 International Energy Agency (IEA) (07/02/2025) Is a turnaround in sight for heat pump markets?

27 Ibid

28 Ibid

29 Ibid

30 S&P Global (11/04/2025) From 6 years to 18 years: The increasing trend of mine lead times

31 Ibid

32 Ibid