Marketing Communication. Capital at Risk. Professional Investors Only. Please read fund legal documentation before making any final investment decisions.

We recently listed the Global X EURO STOXX 50 Covered Call UCITS ETF (SYLD LN).

The Global X EURO STOXX 50 Covered Call UCITS ETF represents Global X’s first covered call strategy on a European index in the UCITS market, and is designed to offer investors an alternative income solution, while potentially avoiding risks seen in traditional income-oriented investments like fixed income and dividend strategies.

Finding income to complement a portfolio and risk profile can – at times – prove to be a difficult task. Options-based strategies may help to generate income, manage risk, or both, depending on the investment objective and policy.

Options strategies may help investors potentially navigate a variety of market conditions or achieve outcomes like generating income or managing risk. Often, these strategies can invest in specific assets, such as the stocks in an index, and buying or selling option calls and puts on those same stocks to attempt to achieve the desired outcome. ETFs investing in options may be an efficient tool for investors looking to incorporate these strategies in their portfolio.

Please see a glossary of terms at the end of this document to be read in conjunction with this material.

A covered call strategy typically involves buying a stock or basket of stocks and selling a call option on those securities. Selling a call option forfeits the upside potential (it limits how much money the strategy could make from investing in a stock or basket of stocks) on those underlying stocks if it’s written at-the-money (ATM). In exchange, the strategy receives a premium (income) for selling the call option. Therefore, a covered call strategy can be used to generate additional income from equities.

Covered Call Strategy Features

Covered Call ETFs

Alternative and Diversified Income Source

These strategies could also diversify an investor’s source of income away from just equities and bonds, which typically struggle in rising rate environments or times of volatility.2 Diversification across asset classes is important because simple diversification, such as the 60/40 portfolio split across equities and fixed income respectively, may not meet investors’ specific income and growth needs.

Home bias can also be inherent in many portfolios where the sector and stock allocations favour the largest companies or specific factors such as dividend stocks. Dividends are generally tied to their earnings which has the propensity to be volatile depending on economic conditions.3

Covered calls could help to diversify that income to be less tied to economic conditions, outside stock or market volatility, which could see more consistent income throughout the year. However, there is still a risk of loss of capital on the investment in a covered call ETF itself and investors may get less back than invested, despite any income paid from the ETF.

Fixed Income investors seeking a higher yield typically take on more duration or credit risk in the bond markets, such as high yield debt and emerging market bonds to achieve higher income returns.

Covered call strategies may generate higher income than preferred equities by collecting option premiums, particularly in range-bound or slightly bullish markets. While preferreds offer fixed dividends that are generally attractive, their yields are typically lower than those of well-managed covered call strategies.4 Covered calls also allow for limited participation in equity upside, although gains are capped at the strike price, whereas preferreds offer minimal capital appreciation and behave more like bonds.5 However, covered call strategies come with equity downside risks - premiums help offset losses but don’t fully protect against declines—while preferreds tend to be less volatile and hold seniority over common stock, though they still carry interest rate and credit risk.6

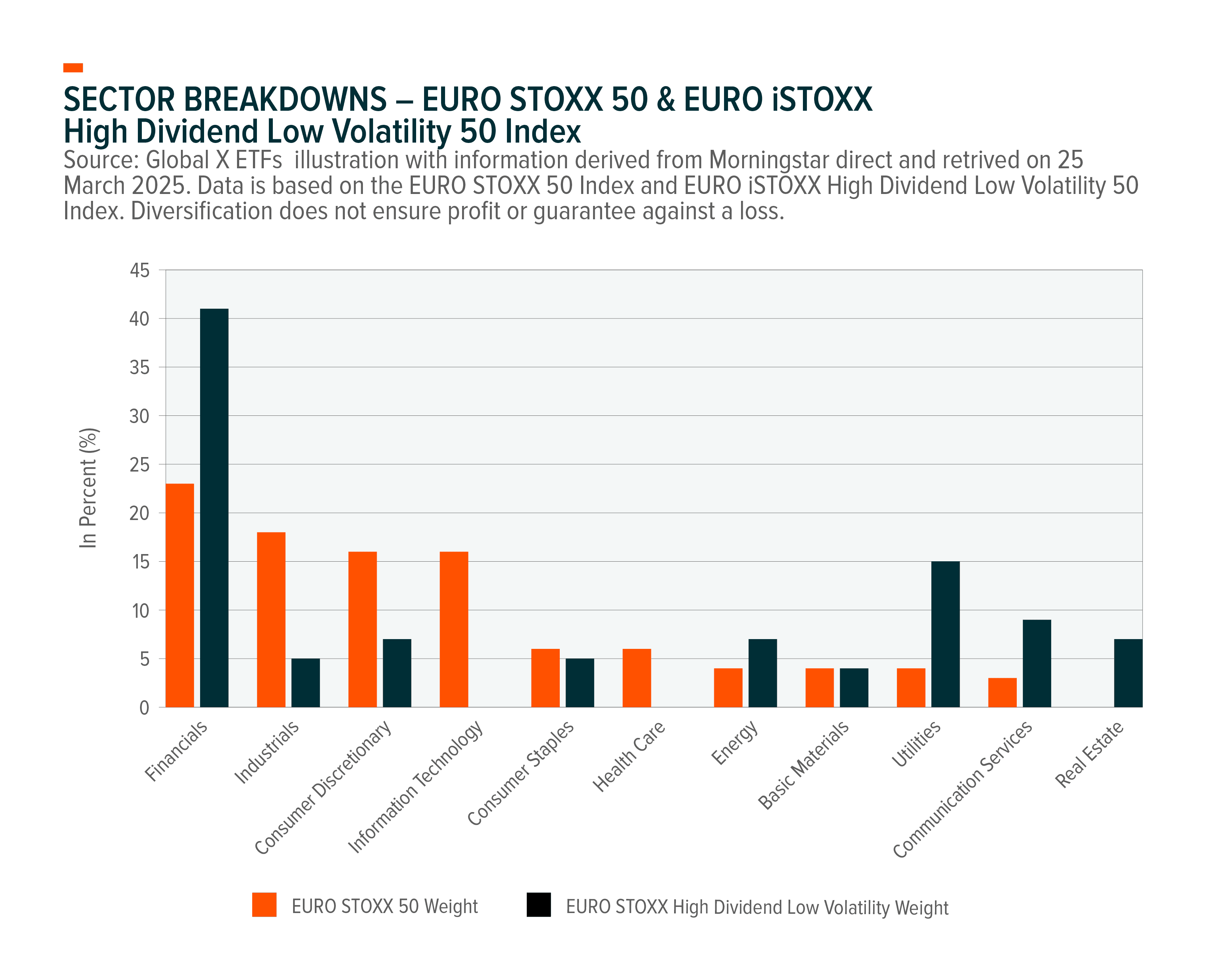

Those exposed to European high dividend strategies tend to be overexposed to sectors that are more cyclical or defensive such as Financials, Real Estate and Utilities and tend to be underweight growth-style sectors such as Information Technology, Consumer Discretionary and Industrial sectors.7,8 A covered call strategy could help to monetise the volatility from premium collection such as higher beta growth-style sectors whilst potentially increasing equity portfolio diversification.

Offers a Potential Buffer During Drawdowns

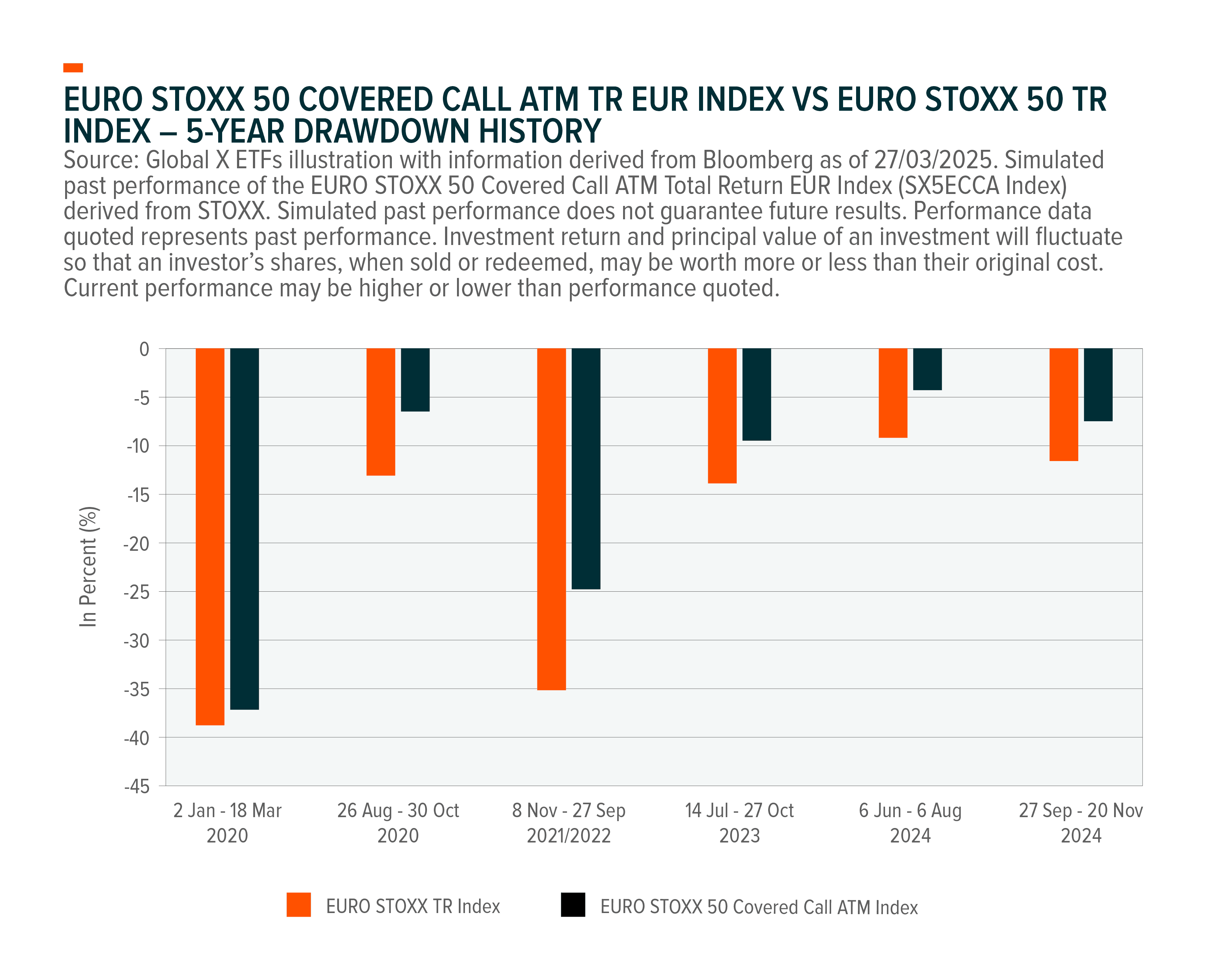

Covered call strategies, by receiving the premium of the sold call option, can potentially help reduce somewhat the effect of a fall of investments in a portfolio during market selloffs as the premiums paid to the ETF provide an additional source of return for the ETF. This is reflected in the graph below, which shows the lower drawdowns of covered call indexes.

However, this does come with a trade-off. In the case of rising stock markets, due to covered calls capping the upside, the gains that could have been made over holding the underlying stock or index are limited. This means investors may not receive as much back from their investment in a covered call ETF as they might had, had they invested in a similar basket of stocks or index such as the EURO STOXX 50 outright.

Options strategies offer investors the potential for flexibility and the ability to shift market factor exposure, which can be particularly attractive during periods of macroeconomic uncertainty and market volatility. They can also offer a range of potential outcomes for investors, the mechanics of which are broken down below.

At-The-Money (ATM) Covered Call Strategies: High Income Potential with possible Reduced Volatility

To begin we need a quick overview of some options language.

The EURO STOXX 50 Covered Call ATM Index tracks the performance of a hypothetical portfolio reflecting a covered call investment strategy based on the EURO STOXX 50 Index, Europe's leading Blue-chip index for the Eurozone.9 The EURO STOXX 50 Covered Call ATM Index reflects a covered call strategy on the EURO STOXX 50 Index as underlying instrument and simultaneously sells monthly European style EURO STOXX 50 ATM call option traded at Eurex.

These strategies seek to generate income by replicating a buy-write index via premiums received from writing calls ATM as this can be appealing to investors seeking income with the potential for reduced volatility in their equity exposure. The ability to collect premiums can potentially mitigate volatility in down markets (where prices of stocks held in the strategy are falling).

What the investor can expect in terms of premiums received depends on how much notional exposure the call option is written, and the moneyness of where it’s written at the money (ATM), out of the money (OTM), or in the money (ITM).

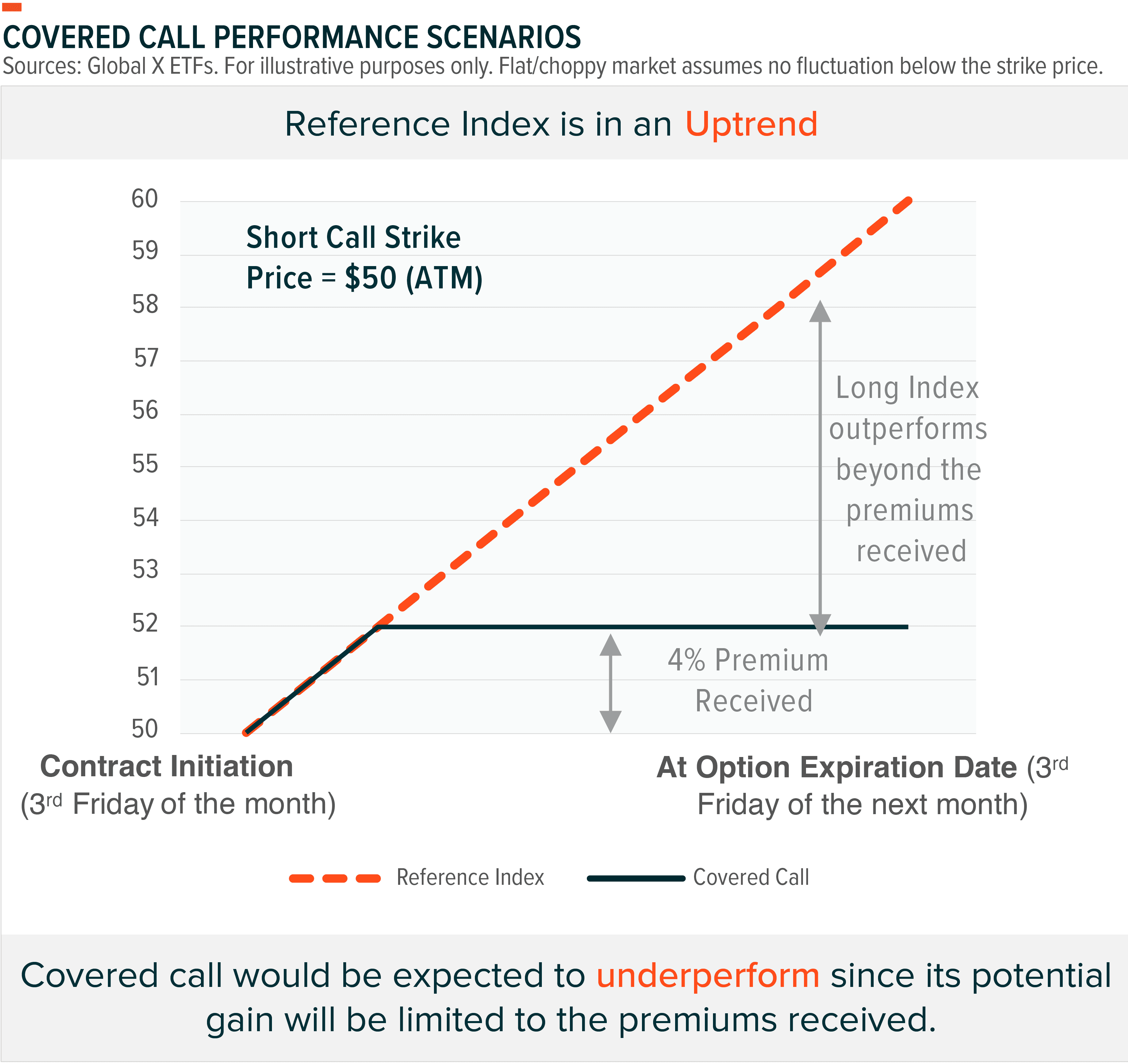

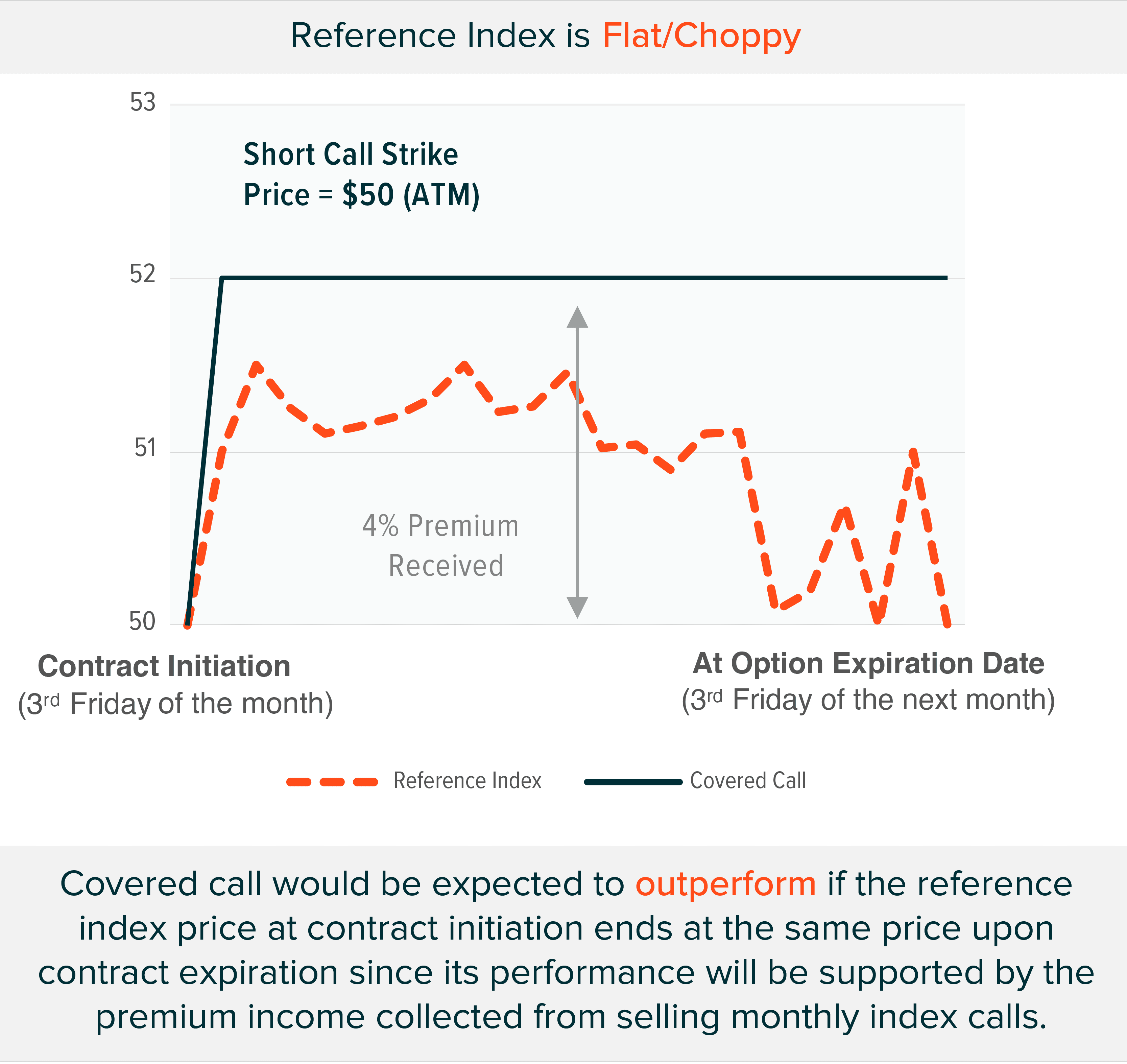

Covered call strategies written ATM forfeit the upside potential in exchange for current income collected from the premiums received from writing the call option. As option premiums tend to rise in volatile markets, covered call strategies tend to perform better in volatile yet sideways markets than in major bull or bear markets.

Covered Calls can be Used Both Strategically and Tactically

For long term strategic investors covered call strategies may be helpful in market environments where income becomes scarce. Covered call strategies can produce high income while diversifying the source of risk in a portfolio as the calls are written on diversified indices such as the EURO STOXX 50 as opposed to single company securities. They can also help increase income certainty and consistency by paying monthly distributions.

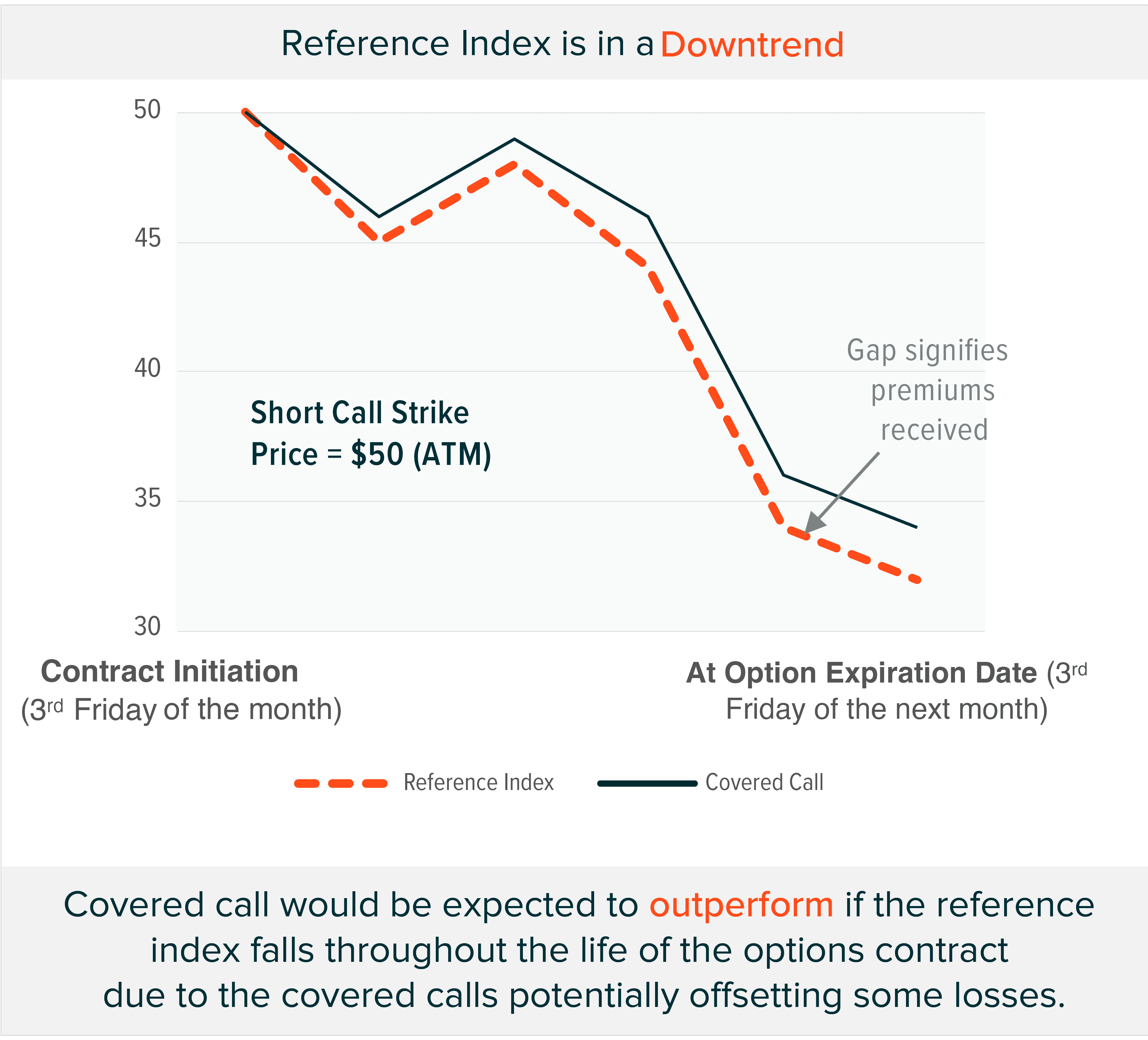

Covered call strategies can be appropriate for tactical portfolios as well, where making a call on market direction can either support or contradict covered call use. Underperformance may occur in a strong up market (where prices of stocks held in the strategy are rising) as the covered call strategy will forfeit the upside of the index exposure held, only receiving the premium. Whereas in a flat market, the strategy may outperform due to the premiums received from selling call options while there is no lost opportunity cost of the underlying index exposure rising. In a down market (where prices of stocks held in the strategy are falling), the strategy may also outperform because they keep the premium received from selling the call option, which may offset some or all of the underlying market’s decline.

Considerations for Investors in SYLD LN

Before investing, investors should ensure they understand covered call option writing risk.

By writing covered call options in return for the receipt of premiums, the Fund will give up the opportunity to benefit from potential increases in the value of the Reference Index above the exercise prices of such options, but will continue to bear the risk of declines in the value of the Reference Index. The premiums received from the options may not be sufficient to offset any losses sustained from the volatility of the underlying stocks over time.

As a result, the risks associated with writing covered call options may be similar to the risks associated with writing put options. In addition, the Fund’s ability to sell the securities underlying the options will be limited while the options are in effect unless the Fund cancels out the option positions through the purchase of offsetting identical options prior to the expiration of the written options. Exchanges may suspend the trading of options in volatile markets. If trading is suspended, the Fund may be unable to write options at times that may be desirable or advantageous to do so, which may increase the risk of tracking error.

Investors should be willing to accept a high degree of volatility in the price of the fund’s shares and the possibility of significant losses.

The risks of investing in SYLD LN are Currency Risk, Derivatives Risk, Equities Risk, Swaps Counterparty Risk, Covered Call Option Writing Risk, Market Risk, Operational Risk (including safekeeping of assets), Risks associated with the ability to track an index, Liquidity Risk and Fund Counterparties. More details regarding the risks of investing and in this ETF specifically is available in the ‘Risk Factors’ section of the Prospectus).

Options-based strategies can help investors navigate various market conditions, including the type of geopolitical uncertainty, elevated rising interest rate, inflation-driven volatility and sector concentration experienced in the market at a given time. These strategies may help investors achieve certain objectives like generating income or managing downside risk. For example, compared to traditional equity opportunities, certain option strategies may achieve a more efficient balance of income and growth and increase portfolio yield. Markets are variable, but certain options strategies, including those offered by Global X, could help provide investors some stability amid uncertainty.

Investors can consider using covered call strategies in a portfolio as:

Global X insights do not take into account a person’s own financial position or circumstances of any person or entity in any region or jurisdiction. This information should not be relied upon as a primary basis for any investment decision. Its applicability will depend on the particular circumstances of each investor. Any views and opinions are based on current market conditions and are subject to change. This information is not intended to be, nor does it constitute, investment research.

1. Black, F., & Scholes, M. (1973). "The Pricing of Options and Corporate Liabilities." Journal of Political Economy, 81(3), 637-654.

2. Lettau,M. & Wachter, J. The term structures of equity and interest rates. July 2011.

3. Cowie, I. H, Home bias hurting portfolios?. December 2017.

4. Rabener, N. Covered Call Strategies Uncovered. CAIA. February 2024.

5. Girdler,C.,RBC Dominion Securities Inc. A guide to preferred shares. April 2018.

6. Burrow, D. What is Preferred Stock? May 2021.

7. EURO STOXX High Dividend Low Volatility Weight composition derived from Morningstar Direct. As of 25/03/2025.

8. Unigestion. Enhancing income investing with artificial intelligence. March 2024.

9. STOXX. Eurostoxx 50. Accessed May 2025.