As we move deeper into the first quarter, uncertainty persists due to mismatched market and Federal Reserve (Fed) expectations for the interest rates path. When the Fed begins easing rates remains the big question, with the market still expecting a more aggressive cutting cycle than the Fed’s suggesting at this point. By region, the most recent central bank meetings indicate a key divergence between the Fed and the Bank of England (BoE) compared to Europe. It’s possible that the European Central Bank (ECB) cuts rates before the Fed and the BoE given the more marked economic deteriorations in certain European economies, including Germany.

With interest rates at their highest levels in decades, the possibility of deteriorating economic conditions could begin to influence market expectations for cuts. While this scenario creates a tricky environment to navigate, investors may have compelling options, including defined outcome and income-based strategies. In a directionless market that has the potential for higher volatility, these strategies could help investor portfolios cope.

Investment strategies highlighted this month:

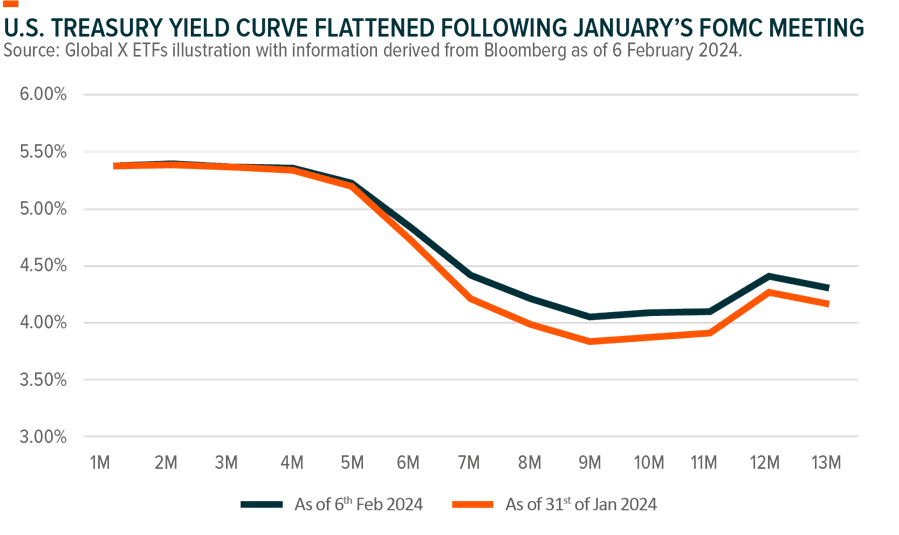

The U.S. economy expanded more than expected in Q4 2023 and unemployment remains at record lows, removing pressures from the Fed to act hastily.1 As a reflection of a brighter economic outlook, the belly and long end of the U.S. Treasury yield curve is more than 20 basis points (bps) higher since the end of last year, causing the U.S.2 Treasury yield curve to flatten. With the latest core Personal Consumption Expenditures (PCE) print at 2.9% year-over-year, the Fed is not far from reaching its goal of price stability.3

However, the stronger than expected U.S. jobs report for January coupled with record low unemployment and a marked acceleration of wage inflation significantly reduces the chances of inflation steadily returning to the Fed’s target.4 As a stated condition for the Federal Open Market Committee (FOMC) to start easing interest rates, the Fed seems likely to hold off on a first cut until the second quarter, perhaps even into the second half. Following the Fed’s January meeting, Chairman Jerome Powell confirmed that view as he pushed back on hopes of a first move at the next meeting in March.5 Markets are now pricing less than five cuts this year, compared to more than six cuts at the beginning of January.6

The Bank of England’s (BoE) hawkish surprise at its February meeting resulted from two votes for higher rates, which caused the pound to retrace most of its pre-announcement loss against the U.S. dollar.7 The UK sovereign yield curve reflected the BoE’s brighter outlook for the economy, with yields rising by about 20bps since the Monetary Policy Committee (MPC) meeting on 1 February.8 Also, market expectations for UK bank rate cuts this year dropped to between three and four from more than four ahead of the meeting.9

In continental Europe, the euro swaps curve is nearly 30bps higher than earlier this year, reflecting the slightly more hawkish tone from European Central Bank (ECB) President Christine Lagarde.10 However, the Overnight Index Swap (OIS) market still prices almost five rates cuts of 25bps for this year.11 The resilient economic conditions and the low level of real rates limit the ECB’s maneuvers, at least in the first half. Based on its latest statement, the ECB seems satisfied with current level of interest rates, as long as the trend of declining inflation continues at this rate and economic conditions stay resilient.12 However, mixed GDP data across Europe could bring forward the start of ECB’s discussions about reducing interest rates to as soon as the next EBC meeting.13

Markets have been alternating between risk-off and risk-on mode since the beginning of the year. Three main risk factors are the culprits for the back-and-forth: 1) central banks’ hawkishness versus market optimism for cuts; 2) disappointing U.S. earnings reports from Big Tech, including disappointing guidance for their artificial intelligence (AI) operations; and 3) concerns about banks’ financial stability following disappointing earnings from banks like New York Community Bancorp in the United States and BNP Paribas and ING in Europe.14, 15.

Should more concerns arise amid persistent yield curve inversions, volatility is likely to increase. The 2-year to 7-year U.S. Treasury yield climbing by over 20bps following the Fed’s hawkish statements on 31 January leave the medium and long end of the U.S.16 Treasury yield curve more prone to selloffs as the market’s rate expectations start to realign with the Fed’s.

The Fed holding off on rate cuts may lead to short-term volatility and keep cash on the sidelines. Instead, one may consider exposure to the elevated front end of the U.S. Treasury yield curve while reassessing their equity strategies. Very short-dated U.S. Treasuries that have close-to-zero credit risk, duration risk, or liquidity risk may be an enticing defensive tactical allocation.

In preparation for lower interest rates in the second half, it is believed that covered call strategies may be an appealing way to earn a relatively attractive yield compared to cash while also gaining beta exposure. The VIX and VXN volatility indices are trending higher since mid-December, possibly indicating increased volatility premiums in the near term.17Also, valuation concerns increased after Big Tech’s disappointing guidance on AI growth despite strong overall revenue growth from Microsoft, Alphabet, and AMD. Despite solid fundamentals, the tech mega-cap stocks may face limited upside in the short term, as current prices reflect already high expectations.

Covered call strategies on the Nasdaq 100 Index may allow investors to maintain exposure to large-cap tech names that are richly valued and thus more prone to market corrections, especially if market expectations realign with the Fed on rate cuts.

Alternatively, defined outcome, or buffer, strategies offer exposure to the returns of broad equity markets, like the S&P 500 Index, to a cap over a specified period. Buffer strategies use systematic option overlays to set a predetermined level of downside protection in exchange for some upside participation. With the uncertainty in the economic outlook and the forward rates path, upside potential for the broader equity market may be limited, with risks skewed to the downside. In this scenario, buffer strategies could be a compelling option.