Marketing Communication. Capital at Risk. For Professional Investors Only.

Valuation multiples are rising, but this expansion is being driven by something more durable than hype. Underpinning it is a broad shift in corporate profitability powered by AI led operational efficiency and margin improvement. This is not a temporary uplift, it reflects a step change in how businesses allocate capital and drive earnings growth. The extent to which multiples can continue to rise will depend on two critical forces: the depth of productivity gains and how those gains affect broader consumer spending. The ideal scenario is one where companies use newfound efficiency not just to cut costs, but to reinvest in growth and employment, fuelling a virtuous cycle of demand and earnings power.

As political headlines and macro uncertainty create noise, innovation is quietly accelerating beneath the surface. This is not a moment to de-risk, it is a moment to reallocate and broaden. We are entering a new industrial era, marked by the convergence of artificial intelligence, infrastructure development, clean energy, and next-generation healthcare. In this piece, we explore three investable themes emerging from that shift: AI monetisation, infrastructure spending in Europe, which is ramping up across energy, transport and defence, and digital finance rails, which are being institutionalised via stablecoin regulation and blockchain integration.

Key Takeaways

Artificial Intelligence (AI) appears to have moved from abstract promise to tangible profit. Q2 earnings season offered the clearest validation yet that AI is not just a capital expenditure (CapEx) sinkhole but is now delivering economic value. Microsoft posted its fastest revenue growth since the launch of ChatGPT, with Azure surpassing $75 billion in annual revenue, up 39% year-over-year.6 Its $80 billion infrastructure budget for fiscal 2025 signals not just ambition, but confidence in economic value.7 Meta Platforms also exceeded expectations, with 22% revenue growth and 36% earnings growth, fuelled by AI-driven improvements in ad targeting, placement, and user engagement.8 The company raised its 2025 CapEx guidance to $66-72 billion, launched a new “superintelligence” lab, and is aggressively recruiting top-tier AI talent.9

The message is clear; the narrative has shifted. AI is no longer just about building powerful models. It is about deploying them at scale, monetising user-facing interfaces, and embedding intelligence directly into enterprise workflows. This tight feedback loop between CapEx and ROI is likely to sustain a multiyear cycle of reinvestment, competitive acceleration, and infrastructure scale-out.

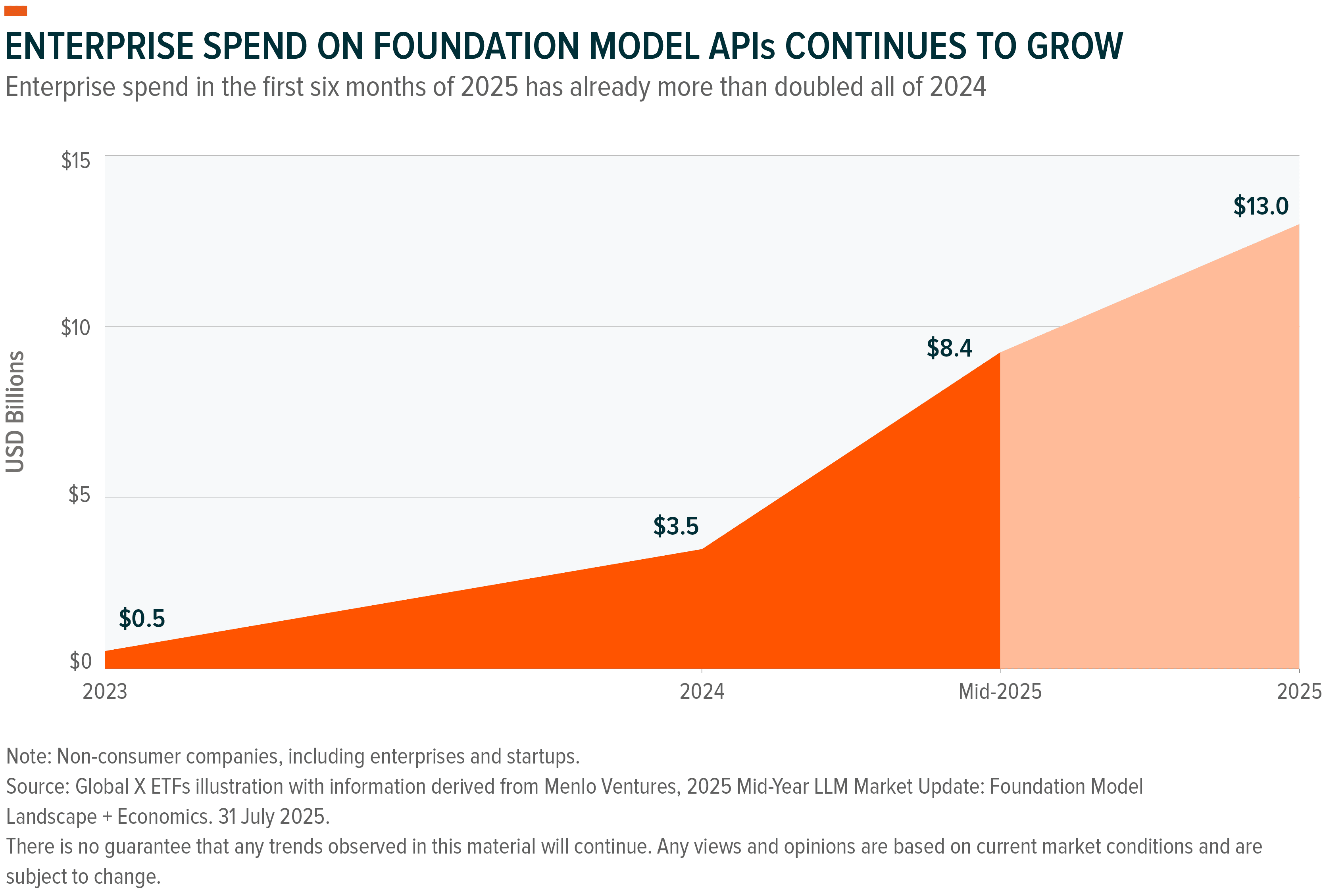

Model API spending has more than doubled in a short span, rising from $3.5 billion (out of the $13.8 billion estimated for total generative AI spend last year) to $8.4 billion.10 This jump demonstrates that enterprises are now allocating more resources to production inference rather than just model development, reflecting a meaningful shift from experimentation to deployment.

As the AI conversation evolves from the “what” (capability) to the “how” (scalable, dependable implementation), infrastructure players are moving from the sidelines to centre stage.11 While model scaling remains technically impressive, it is becoming increasingly commoditised.12 The key differentiator now is not who builds the most advanced model, but who delivers it to end users in a meaningful way.13 In this second phase of the AI cycle, margin leadership will likely shift toward those who can effectively deploy and commercialise the technology, not just those who create it.14 Over the next one to two years, growth will likely concentrate in companies that turn capabilities into tangible products and productivity.

On 16 July 2025, the European Commission proposed its near-€2 trillion 2028-2034 EU budget, the Multiannual Financial Framework (MFF).15 EU representatives have until the end of 2027 to finalise it.16 At its core is a renewed focus on competitiveness, flagged as a strategic imperative in both the Draghi and Letta reports.17,18

The proposed €409 billion European Competitiveness Fund (in current prices) directs €234.3 billion toward four policy pillars: clean transition and industrial decarbonisation; health, biotech and bioeconomy; digital leadership; and resilience, defence industry and space.19 Infrastructure developers and operators across these areas, could benefit from the fiscal stimulus, particularly considering the sharp rise in commitments relative to the 2021-2027 budget.20

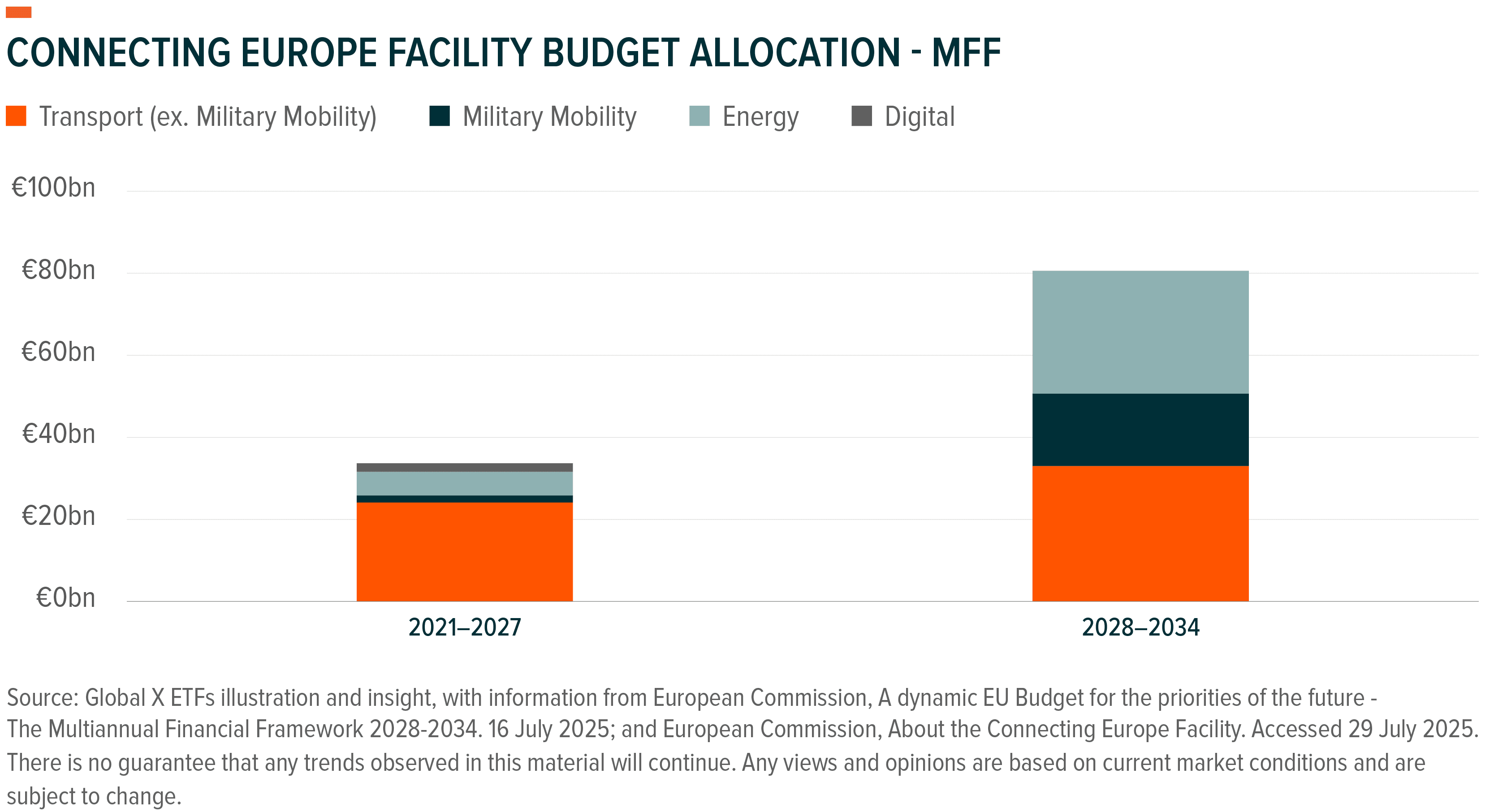

Also notable is the €81.4 billion allocated for the Connecting Europe Facility (CEF) under the proposed 2028-2034 MFF,21 more than double the allocation in the 2021-2027 budget. This includes €51.5 billion for Transport, €29.9 billion for Energy and €17.7 billion earmarked for military mobility.22 The latter aligns with the EU’s Readiness 2030 White Paper, which flagged over 500 land, sea, rail and air projects in need of urgent upgrades,23 as well as the European Commission’s plans to propose a Military Mobility Package by 2025 year-end.24 As EU transport chief Apostolos Tzitzikostas told the Financial Times, ““We have old bridges that need to be upgraded. We have narrow bridges that need to be widened. And we have nonexistent bridges to be built.”25 The significant increase in funding highlights the rising urgency and the tightening link between infrastructure and strategic priorities such as defence.

As discussed in a previous insight, infrastructure spending is not just accelerating at the EU level. Member states are also moving independently. Germany’s €500 billion Special Infrastructure Fund,26 is the standout. To add further momentum, more than 60 companies and investors signed onto the “Made for Germany” initiative in July, committing €631 billion in private investment in Germany over the next three years.27 Echoing recent U.S. policy, which spurred over $1 trillion in announced private-sector investments under the previous administration,28 Federal Chancellor Merz noted that public funds alone won’t meet Germany’s investment challenges and that the majority needs to be provided by private investors.29 The shift in sentiment around Germany’s investment climate could unlock further infrastructure development opportunities, and builds upon the already-strong fiscal response.

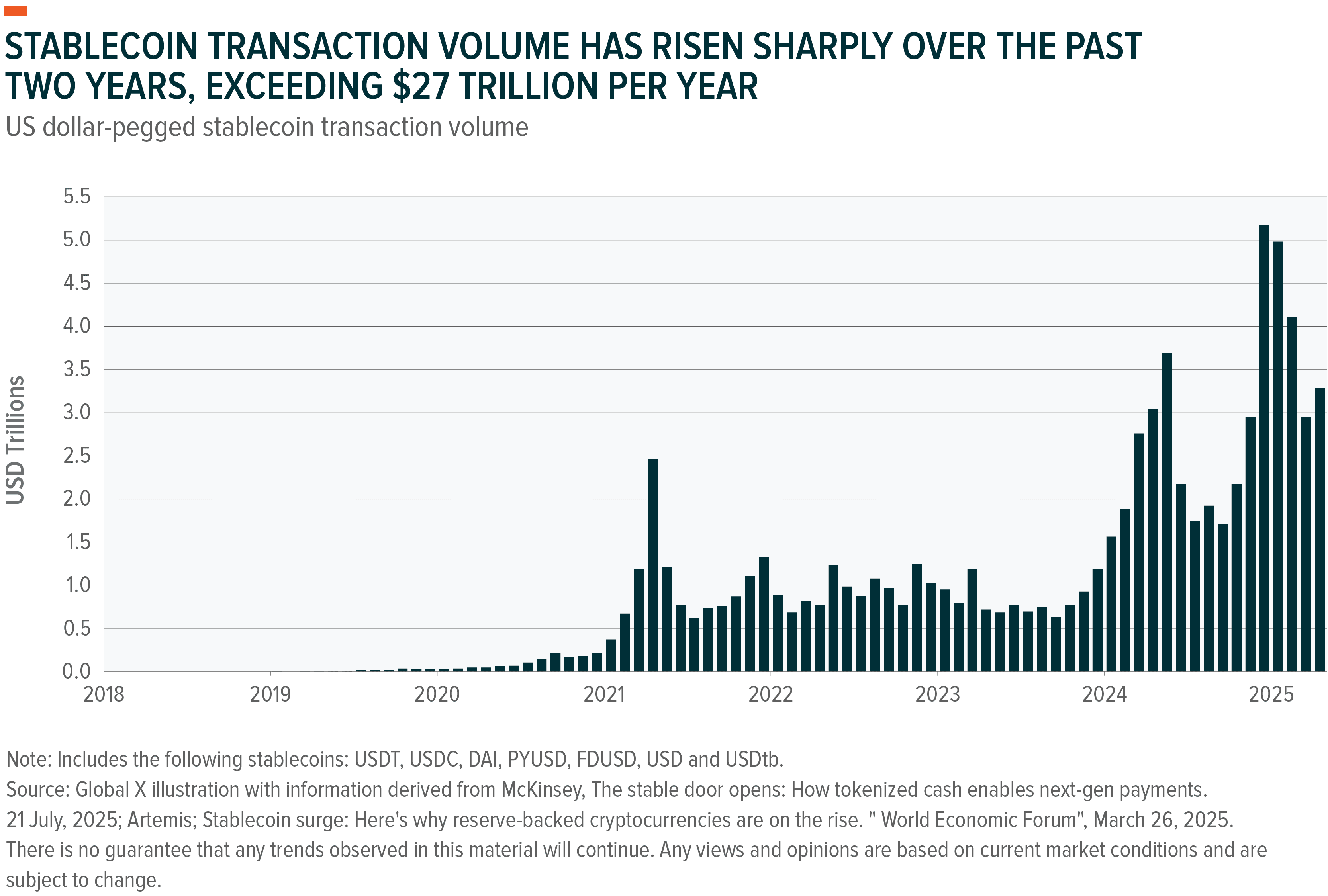

On July 18, President Trump signed the GENIUS Act, establishing a regulatory framework for the US stablecoin market.30 Stablecoins are digital assets designed to maintain stable value against the dollar.31 With major retailers like Walmart and Amazon exploring their own stablecoins to bypass traditional payment networks, stablecoins seem poised for mainstream adoption.32 Meanwhile, two significant crypto regulations remain pending: the CLARITY Act, which would shift oversight of most digital assets to the CFTC, and the Anti-CBDC Surveillance State Act, aimed at preventing the Federal Reserve from issuing a CBDC without Congressional approval.33 Over 90% of finance executives surveyed by Ripple expect blockchain to significantly impact finance by 2028, with 65% of banks actively exploring digital asset custody, particularly stablecoins and tokenised real-world assets.34

Institutional adoption is shifting away from retail crypto towards upgrading core infrastructure, such as cross-border payments, collateral management, and balance sheet efficiency. Real-world use cases are accelerating; HSBC has launched a tokenised gold platform; Goldman Sachs is deploying its blockchain settlement system GS DAP; and Lloyds and Aberdeen recently piloted FX trades using tokenised assets via the Archax exchange.35,36 JPMorgan’s Onyx platform has already processed over $1.5 trillion in blockchain-based institutional transactions, illustrating blockchain’s growing role in modern finance.37

In response to surging demand for compute capacity amid tight supply, crypto-native firms with access to low-cost power are pivoting toward AI cloud services. Iris Energy exemplifies this trend, leveraging Bitcoin mining cash flows to build renewable-powered data centres that rent ultra-high-performance GPU compute to AI startups on an hourly basis, akin to AWS but specialised for AI workloads.38

On the consumer finance front, JPMorgan Chase and Coinbase have forged a strategic partnership to bridge traditional banking and digital assets.39 Starting fall 2025, Chase customers can fund Coinbase accounts using Chase credit cards, with expanded features in 2026 including direct bank-to-wallet links and the ability to convert Chase Ultimate Rewards points into crypto, a first for a major credit card program.40 This move signals the growing institutional embrace of crypto amid rising retail demand, offering seamless, secure integration for over 80 million Chase customers,41 and marking a key milestone in mainstream crypto adoption.

The market is undergoing a profound transformation, one that extends beyond short-term macro narratives. AI is no longer a conceptual innovation but a productivity engine reshaping how enterprises operate and allocate capital. In parallel, Europe’s renewed focus on strategic infrastructure is unlocking a new era of investment across energy, transport, and defence, supported by both public funding and unprecedented private-sector engagement. Meanwhile, blockchain technology is moving firmly into the institutional domain, with regulatory clarity accelerating its integration into the core infrastructure of global finance.

These developments mark the early stages of a broader industrial realignment, where capital, technology, and policy are converging to redefine the investment landscape. In this context, the opportunity is not simply to defend against volatility, but to position portfolios for long-term relevance and resilience.