Marketing Communication. Capital at Risk. For Professional Investors Only.

Europe is executing a long-term strategy to build a sustainable, digital, and inclusive economy, anchored by investment in core infrastructure. The European Commission has outlined ambitious goals for 2024-2029, emphasising competitiveness, security, and a robust social model to address contemporary challenges ranging from economic shifts to energy security.1 This strategic direction translates into large-scale investment in critical infrastructure, supported by public and private capital through initiatives like NextGenerationEU (NGEU) and the Recovery and Resilience Facility (RRF).2 The growing role of defence spending and the launch of national infrastructure funds,3 further position infrastructure as both economic stimulus and geopolitical necessity in Europe.

Key takeaways:

Let's Get Digital, Digital

The EU is advancing a coordinated strategy to strengthen its position in artificial intelligence (AI). The AI Continent Action Plan builds upon the InvestAI initiative, which seeks to mobilise €200 billion for AI investment in the EU, including €20 billion earmarked for up to 5 AI “gigafactories” capable of supporting frontier AI model training with over 100,000 advanced chips each.11 The plan also proposes the establishment of at least 13 AI factories across Europe, to support startups, industry, and research teams to develop cutting-edge AI models.12 These developments rest on public-private financing mechanisms designed to combine regulatory assurance with market dynamism.

To complement the compute infrastructure, the proposed Cloud and AI Development Act aims to at least triple the EU’s data centre capacity within the next five to seven years, with a focus on sustainability.13 This initiative seeks to address persistent barriers, such as protracted permitting timelines and constrained access to energy and water, by incentivising efficient, green data centres through streamlined approvals and support mechanisms.14 Still, as projections indicate that global data centre electricity consumption may more than double by 2030,15 the plan highlights a critical intersection of digital expansion and energy strategy. The Climate Neutral Data Centre Pact, supported by major EU providers, now pledges 100% carbon-free energy and energy- and water-efficiency standards by 2030, a testament to the evolving nexus of digital and clean‑energy infrastructure.16

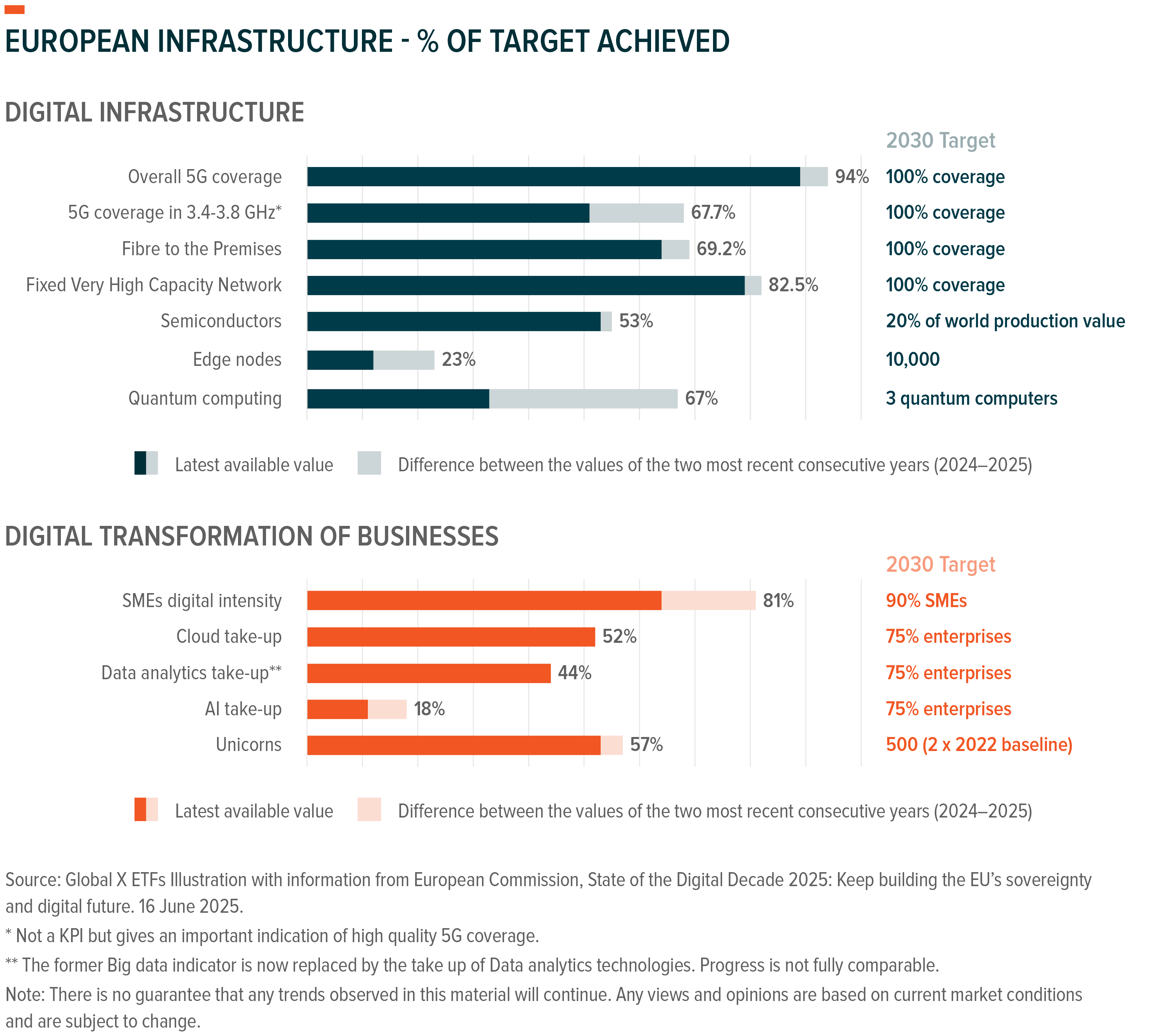

Given the importance of achieving the EU’s Digital Decade Policy Programme 2030 (Digital Decade) targets, EU member states have developed National Digital Decade strategic roadmaps (National Roadmaps), with collective committed investments totalling €288.6 billion, with €205.1 billion coming from public budgets (equivalent to 1.14% of EU’s GDP).17 Despite these significant commitments, progress towards the Digital Decade targets since July 2024 has been uneven. Areas such as the deployment of edge notes and the rollout of ‘basic’ 5G radio coverage show strong progress towards 2030 targets.18 However, the adoption of foundational digital technologies like AI, cloud services, and data analytics has been slower and is currently well below 2030 targets.19 Similarly, implementation of 2024 EU-level recommendations have shown mixed results. While 45% of EU-level recommendations showed notable (35%) or significant (10%) progress (10%), 48% showed limited progress and 7% saw none.20 These figures underscore ongoing challenges in deploying and integrating digital technologies across the EU, compounded by regulatory fragmentation and administrative complexity.

The EU recognised these challenges in its “How to master Europe’s digital infrastructure needs?” whitepaper,21 which presents potential solutions. The inclusion of telecommunications networks in the EU’s sustainable activity taxonomy could unlock financing by enabling qualifying projects or operators to access green financing tools.22 Providing EU-level regulatory certainty and uniformity around spectrum licensing could reduce delays in the buildout of 5G and future spectrums, and ensure consistency across markets.23 Consistent with Mario Draghi’s report on EU competitiveness,24 the possibility of consolidation or the loosening of competition rules within the telecommunications industry, was also raised in the whitepaper.25 Telecommunications companies have reportedly lined up deals in the hope that the EU’s new competition chief, Teresa Ribera, will loosen merger rules.26 The upcoming Digital Networks Act,27 and Gigabit Infrastructure Act,28 provide opportunities for the EU to address these challenges.

Digital infrastructure also intersects with defence across various domains, including cybersecurity, robust communications networks, and supply chain independence in core areas such as semiconductors. AI, Quantum, Cyber & Electronic Warfare is identified as one of seven priority capability areas in the EU’s Readiness 2030 White Paper,29 which highlights the need for greater procurement speed and innovation in these areas. This provides another catalyst for greater funding towards digital capabilities across Europe.

Cultivating Clean Energy Resilience

Amidst growing global divergence on climate policy, Europe stands out by persisting with its long-term climate targets. The EU is on track to reduce net greenhouse gas emissions by 54% by 2030 compared to 1990 levels,30 just shy of its 55% target.31 Looking further ahead, the European Commission has proposed a 90% emission-reduction target for 2040 within the European Climate Law,32 as a stepping stone towards the goal of net zero by 2050. Whether these targets prove fully attainable remains to be seen, but the EU’s willingness to commit now to long-range goals reflects a belief that the costs of inaction, though uncertain in timing, are likely to exceed the costs of preparation.

The EU has also launched the Clean Industrial Deal to foster competitive industries, create quality jobs, and drive decarbonisation.33 The EU aims to mobilise over €100 billion to support EU-made clean manufacturing via the Innovation Fund, and up to €50 billion via amendments to the InvestEU regulation.34 To streamline procedures, it plans to launch an industrial decarbonisation accelerator act to speed up planning, tendering, and permitting for related projects.35 The aim is not only efficiency but also predictability,36 which is crucial for unlocking longer-term capital. Municipalities are actively contributing to this transition, with over half planning to increase investments in climate change adaptation and mitigation over the next three years.37 This bottom-up engagement suggests a growing alignment between EU-level frameworks and local implementation capacity, often a missing link in climate policy.

The RRF, a core component of NextGenerationEU, earmarks approximately 42% of its estimated expenditure for climate objectives, surpassing its 37% target.38 NGEU Green Bonds, which finance up to 30% of NextGenerationEU,39 are a significant part of this effort. Over €68 billion had been issued by the end of 2024,40 positioning the EU as the world’s largest green bond issuer.41 These investments are projected to reduce the EU's greenhouse gas emissions by 55 million tonnes per year, equivalent to 1.5% of all EU GHG emissions.42 The RRF's support for regional and local governments has significantly contributed to the rise in public investment, particularly in Southern and Central and Eastern Europe.43 This injection of funding has helped address long-standing disparities in infrastructure readiness and investment absorption capacity.

Together, these efforts form a policy framework that, while complex, demonstrates the EU’s intention to lead not only through targets, but through coordinated financial and regulatory mechanisms designed to make delivery plausible, not just aspirational. The key takeaways are that the EU is embarking on a more credible trajectory towards net zero, there is a meaningful expansion of climate-related investment opportunities, and that anticipated municipal investment demonstrates that policy momentum and capital flows are beginning to align.

The Moving Parts: Transport Infrastructure

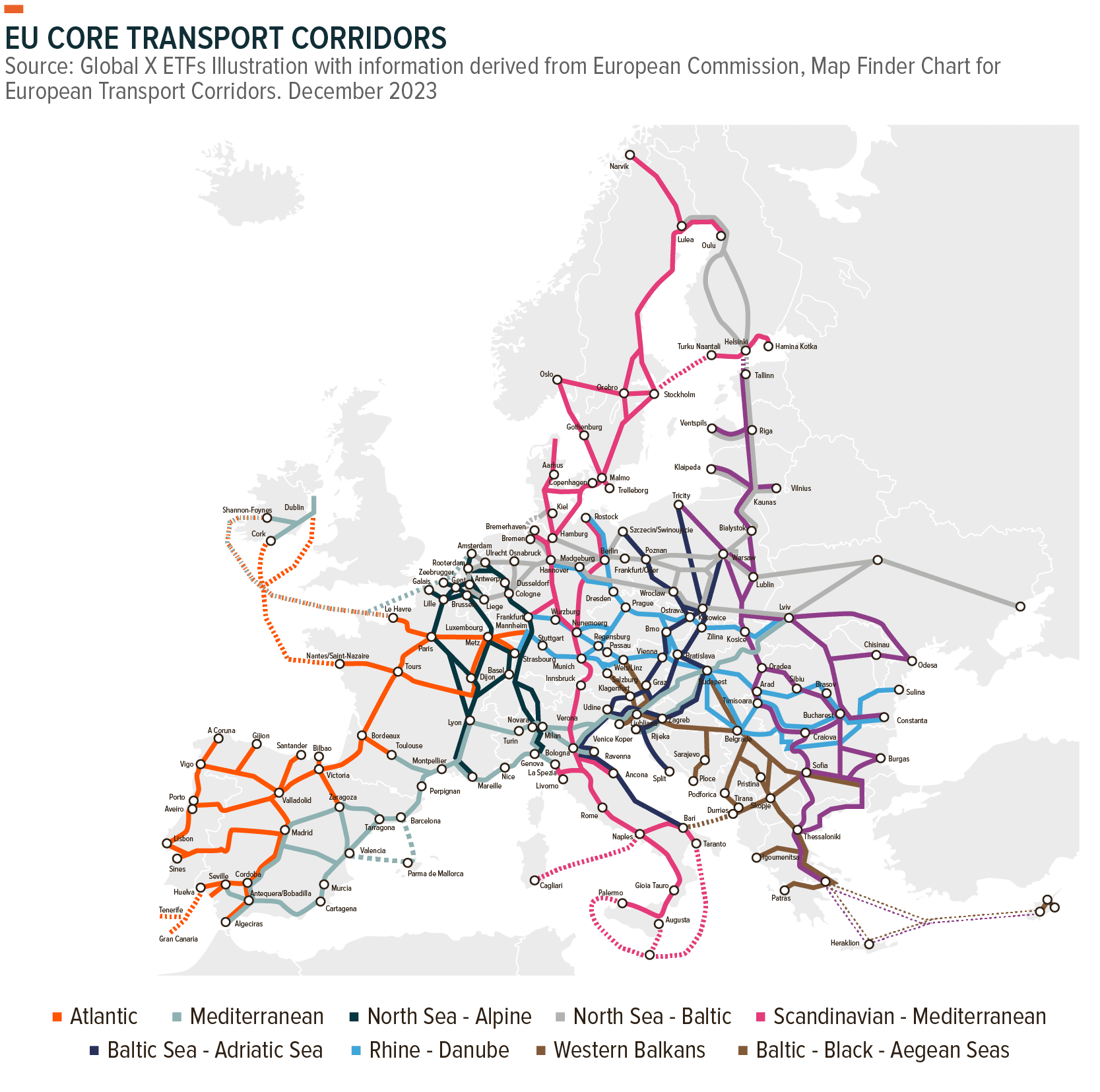

Transport remains crucial to the EU’s goals of competitiveness, climate objectives and connectivity. As discussed in our previous insights,44 central to this is the TEN-T network, which involves the development of a core (by 2030), extended core (by 2040) and comprehensive network (by 2050) across 9 key transport corridors.45 Recently-appointed EU Commissioner for Sustainable Transport and Tourism, Apostolos Tzitzikostas, reiterated the EU’s commitment to completing the TENT-T core network by 2030.46 However, he also noted further funding is required,47 with costs for completing the TEN-T core and extended networks estimated at €866 billion (in 2023 terms).48

The significant demand for transport funding is evident in the €9.5 billion requested across 258 applications under the 2024 Connecting Europe Facility (CEF) Transport calls, almost four times the available €2.5 billion budget.49 This mismatch between ambition and available funding is not new but has become more visible as infrastructure is increasingly treated as strategic policy. This shortfall is also visible at the local level. Approximately half of EU municipalities expressed dissatisfaction with their past investments in urban transport infrastructure.50 However, while the CEF is the main source of funding for EU transport projects, the RRF also contributes to improving transport infrastructure through its funding towards the “green transition” pillar, which includes improvements to transport networks.51

Recent geopolitical developments have heightened the strategic importance of transport infrastructure for Europe’s defence and military readiness. Military mobility is one of seven “priority capability areas” highlighted in the European Commission’s Joint White Paper for European Defence Readiness 2030, which calls for critical transport infrastructure fit for a dual-use purpose (i.e. both military and civilian).52 Consequently, the EU has earmarked 500 projects across four priority corridors (rail, road, sea and air) for urgent upgrades to facilitate large-scale troop and defence equipment movement.53 The CEF has allocated €1.7 billion to support dual-use transport infrastructure for military mobility under the current EU Multiannual Financial Framework (MFF).54

Complementing the funding push is a regulatory effort to streamline delivery. A key objective of the regulation establishing the TEN-T network was to remove infrastructure bottlenecks and enhance coordination of works across EU member states.55 Separately, the development of an EU Military Mobility Package later this year aims to address bottlenecks, procedural obstacles and capability gaps,56 and could enhance the effectiveness of military mobility investment. Finally, under a proposed single digital booking and ticketing regulation, passengers could access passenger rights for their entire journey from a single ticket, streamlining cross-border travel across the EU.57 Each of these measures recognises that greater coordination and regulatory consistency between EU member states is crucial to enabling faster delivery and higher impact.

National infrastructure funds are also targeting transport, notably within Germany’s €500 billion infrastructure fund. Vice-chancellor Lars Klingbeil reportedly plans to allocate €10.5 billion to improving rail infrastructure in 2025, almost half the €22 billion budget.58 This underscores the importance of both developing and renewing transport infrastructure, with Deutsche Bahn having prepared detailed investment projects.59

These efforts suggest that transport infrastructure is no longer just an enabler of economic activity; it is increasingly seen as critical to competitiveness, cohesion and crisis preparedness. This presents a dual opportunity to engage in long-cycle physical infrastructure upgrades and to align with EU priorities that are increasingly backed by both regulatory urgency and political will.

Conclusion

The strategic objectives set by the European Commission for 2024-2029 underscore a strong commitment to enhancing Europe's competitiveness and strategic autonomy through targeted infrastructure investment.60 Programs like NextGenerationEU and the RRF are instrumental in mobilising significant funds, with the RRF having already disbursed €315 billion by the end of May 2025 for over 2,200 milestones and targets in reforms and investments.61 However, to fully realise the potential of these initiatives, a substantial acceleration in implementation is needed across Member States, as considerable funding still awaits disbursement by the end of 2026.62 Achieving this will demand both regulatory simplification and a deeper alignment across national frameworks, especially in areas like permitting, procurement and project delivery. Insufficient funding, regulatory complexities, and skills shortages remain challenges at the local level.63

Despite these hurdles, the EU's focus on strategic public procurement, the development of blended finance tools like InvestEU (expected to mobilise over €372 billion in public and private investment),64 the creation of national infrastructure funds by countries such as Germany, and an increased focus on defence and dual use infrastructure represent coordinated attempts to reduce perceived risk and unlock capital flow into sectors with high policy priority but long investment horizons. The EU’s comprehensive approach to digital transformation, its commitment to green initiatives, and its efforts to streamline implementation across member states and EU institutions are central to building a more coherent, investable infrastructure strategy that seeks to match ambition with execution.