Marketing Communication. Capital at Risk. For Professional Investors Only.

Amid rising geopolitical tensions, Europe finds itself at a critical juncture in its security strategy. Long reliant on American military support, European Union (EU) nations now confront the urgent need to assume greater responsibility for their own defence as the new U.S. administration signals a strategic shift in defence policy.1 This shift could compel EU nations to significantly expand their military budgets.2

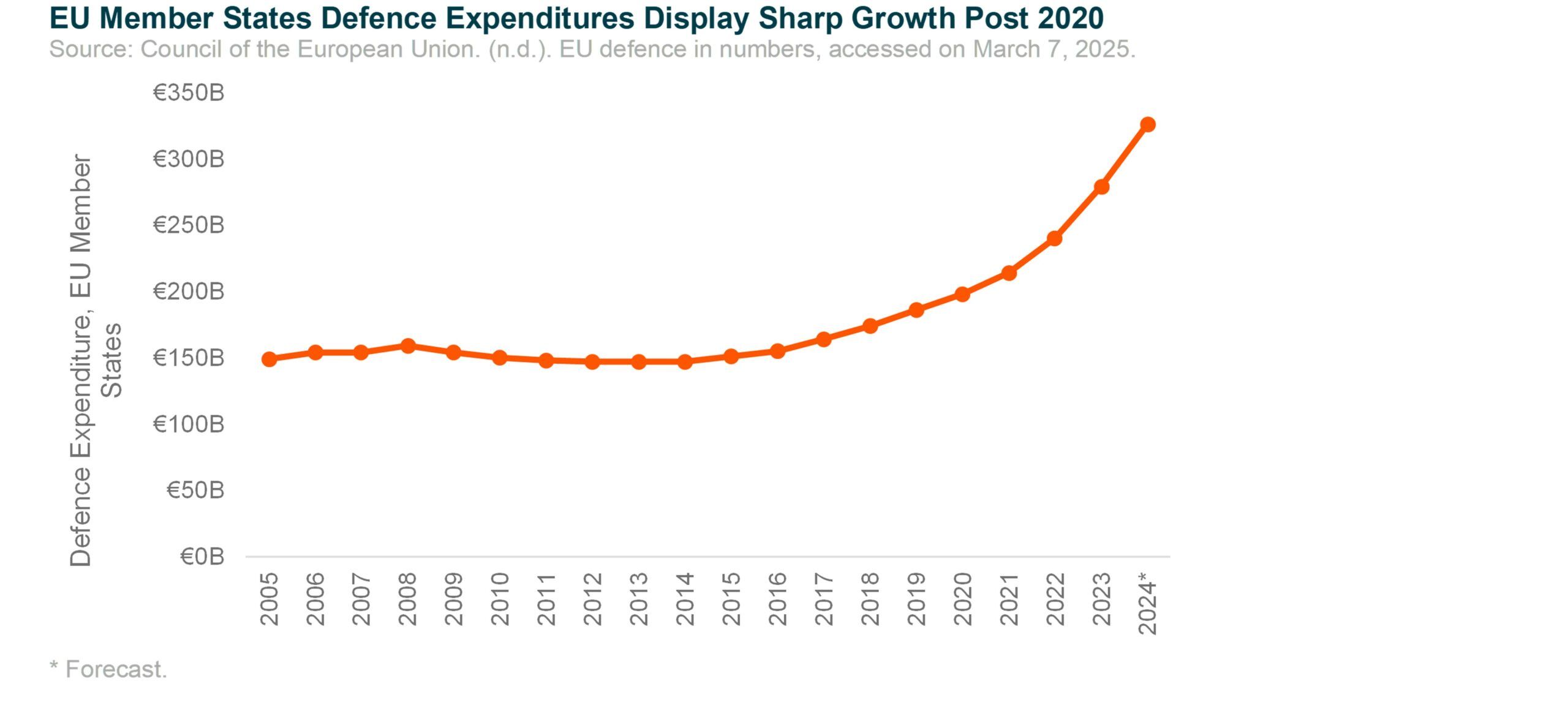

In the first few months of 2025, some major European nations and the European Commission have announced substantial defence spending programs, totalling hundreds of billions of dollars, aimed at strengthening military capabilities through 2030. EU member states, which were estimated to have spent over €326 billion on defence in 2024, are projected to increase expenditures by another €100 billion in real terms by 2027.3

As Europe advances toward greater military self-sufficiency, global defence expenditures may continue to rise, with potentially a particular focus on advanced defence technologies over the next five years. As spending works its way through the value chain, international defence stocks, especially in Europe, could benefit.

The global defence landscape remains highly volatile, with nearly 30 major conflicts ongoing worldwide, according to the Council on Foreign Relations.6 Against this backdrop, the new U.S. administration’s 'America-first' stance, coupled with direct negotiations with Russia over the Ukraine war, is forcing Europe to reassess its defence strategy. Many European nations are now acknowledging decades of underinvestment in defence, with some already committing to increased spending.7

Meanwhile, the new Trump-administration is pursuing a bold defence strategy domestically, aiming to cut waste while modernising its military capabilities with AI, autonomous weapons, drones, and robotics. Budget freed from legacy programs is expected to further accelerate defence modernisation efforts, which could benefit key defence technology providers.8

These advancements are not occurring in isolation. As the U.S. modernises its military capabilities, other nations could well feel compelled to strengthen their own defence technology arsenals. This momentum, compounded by Europe’s commitments, could drive total global defence spending higher through 2030.9

Prior to the new U.S. administration’s defence messaging, Europe had already been undergoing a historic rearmament phase, with defence budgets expanding at a pace not seen since the Cold War.10 For example, European military budgets grew 10% in 2023 to €279 billion, marking the ninth consecutive year of growth.11

Additionally, National Atlantic Treaty Organisation (NATO) European members are expected to add $100 billion in new defence spending between 2022 and 2024.12 By the end of 2024, at least 20 NATO members are expected to meet or exceed the 2% of Gross Domestic Product (GDP) defence spending target, up from only 9 members in 2021.13,14 Germany, France, and Poland are leading the spending surge, with Germany’s military budget expanding by 25% to roughly €86 billion in 2024 alone, making it the world’s third-largest defence spender behind the U.S. and China.15

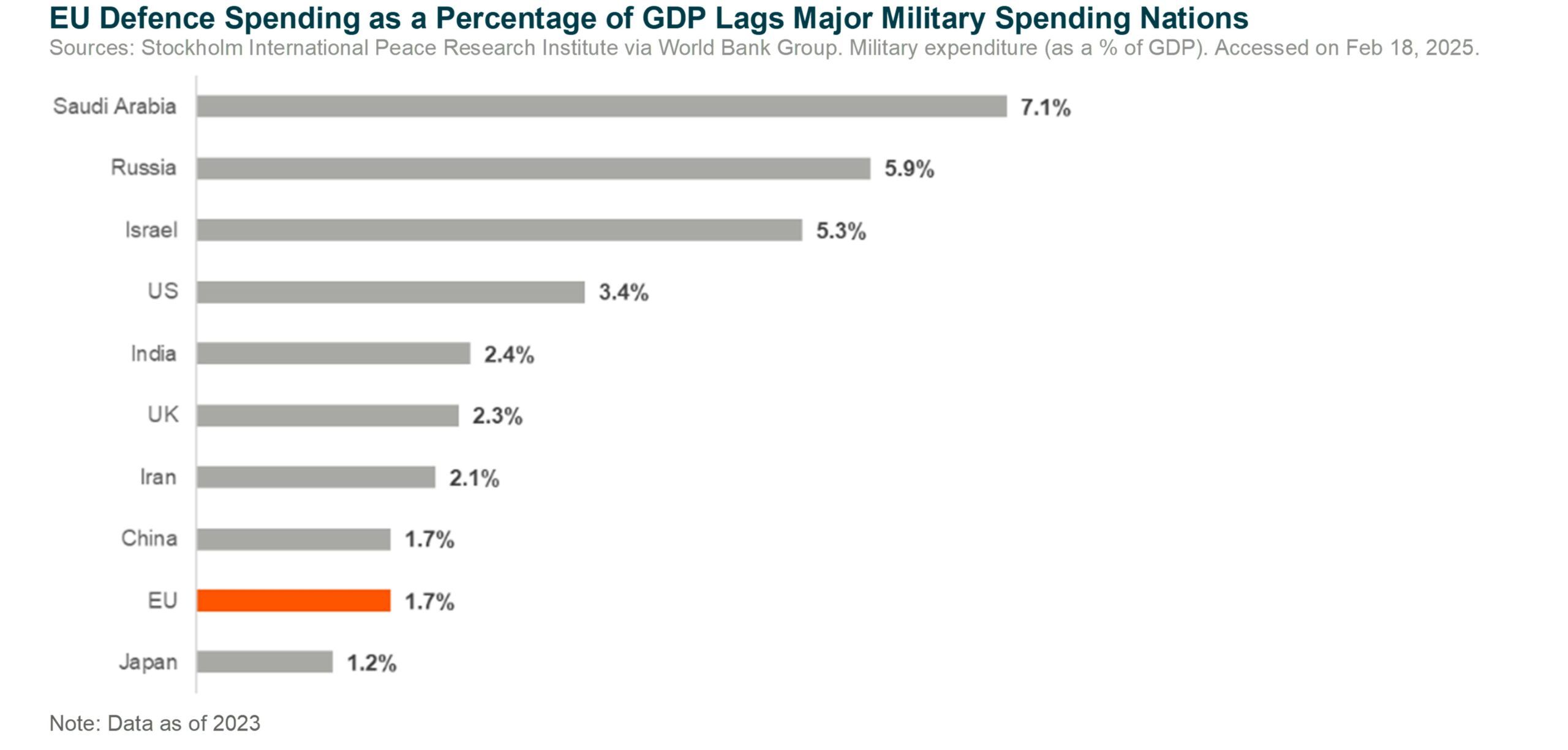

Despite the urgency, some European nations still lag other military powers in terms of defence expenditure as a percentage of GDP. The region’s defence spending commitments are growing, but they remain far below the new ambitions set by NATO’s leadership and key members, meaning further spending growth could remain ahead. Recent spending initiatives potentially signal momentum in this direction.

Moreover, new equipment procurement and development remains central of Europe’s defence expenditure growth. In 2024, the budget spent on new equipment procurement is expected to have reached beyond €90 billion, nearly 50% higher compared to 2023, and nearly 27% of the total budget. Similarly, spending on research and development grew 18% YoY in 2024 to €13 billion. This expansion could continue over the next few years, signalling a broad effort to modernise defence capabilities.22

Despite record military expenditures, in the U.S., defence remains one of the least digitised industries, with less than 1% of its military budget allocated to software and digital capabilities.23 The U.S. and its allies are recognising this gap, leading to an accelerated push toward AI, cybersecurity, and digital warfare.24

Recent conflicts, such as those in Ukraine and the Middle East, have highlighted the critical advantages of technology - particularly real-time, data-driven decision-making, which could drive upgrades in defence software infrastructure. Beyond operational superiority, technology could also deliver cost advantages on the battlefield, reinforcing the strategic importance of defence tech solutions.25 Worldwide, and in Europe, companies specialising in advanced defence systems and defence-tech infrastructure may be poised to potentially benefit from sustained investment.

As global geopolitical uncertainty increases, defence spending could be set for secular expansion this decade. The U.S. realigning its strategic priorities could push Europe toward greater military self-reliance, driving increased procurement and benefiting some of the region’s largest defence contractors. Companies across the defence technology value chain - including software, components, hardware, drones, autonomy, and sensors - appear potentially positioned for sustained growth. For investors looking to capitalise on this generational transformation of the global defence order, a diversified global approach with a strong focus on defence technology may be key.

1. Sky News. (2025, Feb 12). US defence secretary signals dramatic shift in American military policy away from Europe, warning allies about “stark strategic realities”.

2. Global X Forecast with information derived Stockholm International Peace Research Institute. SIPRI Military Expenditure Database: Military expenditure by region in constant US dollars. (2024, April 22).

3. Council of the European Union. (N.d). EU defence in numbers. Accessed of March 6, 2025.

4. Wall Street Journal. (2025, March 4). EU Floats $158 Billion Fund to Boost Military Spending After U.S. Halts Ukraine Aid.

5. Royal United Services Institute (2025, March). “European Digital Defence Priorities in an Uncertain World”

6. Global Conflict Tracker. Center for Preventative Action, Council on Foreign Relations. https://www.cfr.org/global-conflict-tracker/?category=us.(2025)

7. PBS News. (2025, Feb 12). Trump says he and Putin have agreed to begin ‘negotiations’ on ending Ukraine war.

8. The Washington Post (2025, Jan 21). Cheap, smart, deadly. The tech industry pitches a new way to wage war.

9. Global Defense News (2024, Nov 21). 35 Modernization Programs: How US Army is Shaping Its Future for 2030 to Tackle Emerging Threats

10. Wall Street Journal. (2025, March 4). EU Floats $158 Billion Fund to Boost Military Spending After U.S. Halts Ukraine Aid.

11. European Defence Agency. (2024, December 4). EU defence spending hits new records in 2023, 2024.

12. Nato. (n.d.) Defence Expenditures of NATO Countries (2014-2024). Accessed on March 6, 2025.

13. Reuters. (2024, June 17). Over 20 NATO allies to spend at least 2% of GDP on defense in 2024, says Stoltenberg

14. Gov.uk (2021, Nov 11). Finance and economics annual statistical bulletin: international defence 2021

15. MSN.com. (2025, March 4). Germany Paves Way for Defence Spending Increase.

16. Bloomberg. (2025, February 18). UK Plans FTSE Firm-Style Unit for £20 Billion Defence Spending.

17. The Guardian. (2025, March 6). ‘Watershed moment’: EU leaders close to agreeing €800bn defence plan.

18. The Wall Street Journal. (2025, February 17). European Defence Stocks Rise on NATO Remarks on Military Spending Boost.

19. The Wall Street Journal. (2025, March 4). Germany Paves Way for Defence Spending Increase.

20. France24. (2025, February 18). EU pledges to boost defence spending to ensure Ukraine security.

21. The Wall Street Journal. (2025, February 12). European Defence Startups Drive $5.2 Billion Funding Spree in 2024.

22. Council of the European Union. (N.d). EU defence in numbers. Accessed of March 6, 2025.

23. Cost Assessment and Program Evaluation (CAPE) in the Office of the Secretary of Defence (OSD). (2023, May). Department of Defence Information Technology and Cyberspace 24. 24. Activities Budget Overview: President’s Budget (PB) 2024 Budget Request. U.S. Department of Defence.

25. Centre for Innovation Governance Innovation (2025, Feb 26). Militarizing AI: How to Catch the Digital Dragon?

26. Business Insider (March 2025) “Ukrainians hunting Russian drones flying double barrel recoilless shotgun”

27. Fortune.com (2025, Mar 16). “Rheinmetall’s stock has soared over 1,000%, and the German defense giant sees growth ‘that we have never experienced before”

28. The Defence Post. (2025, February 11). Rheinmetall Awarded Largest-Ever German Soldier-System Contract.

29. FactSet. (n.d). Accessed on Feb 19, 2025.

30. Thales. (2025, February 12). Thales to maintain Royal Navy ships and submarines communications.

30. Thales. (2024, December 3). Thales completes the acquisition of Imperva, creating a global leader in cybersecurity.

31. The Manufacturer (2025, Feb 20). “BAE Systems announces 14% revenue increase and record profits for 2024”

32. The Wall Street Journal. (2025, February 19). BAE Systems Posts Double-Digit Jump in Sales as Defence Budgets Climb.