Marketing Communication. Capital at Risk. For Professional Investors Only.

The chance of peace talks between Ukraine and Russia appears to have increased after U.S. President Donald Trump hosted talks in August with Russia President Vladimir Putin and Ukraine President Volodymyr Zelenskyy.1,2 Shortly after this, President Trump initiated plans for a Zelenskyy-Putin summit,3 although the willingness to negotiate remains uncertain. Nevertheless, it appears that investors may be shifting their attention towards Ukraine’s reconstruction and the investment opportunities it presents.4

Key takeaways:

What is the scale of reconstruction required?

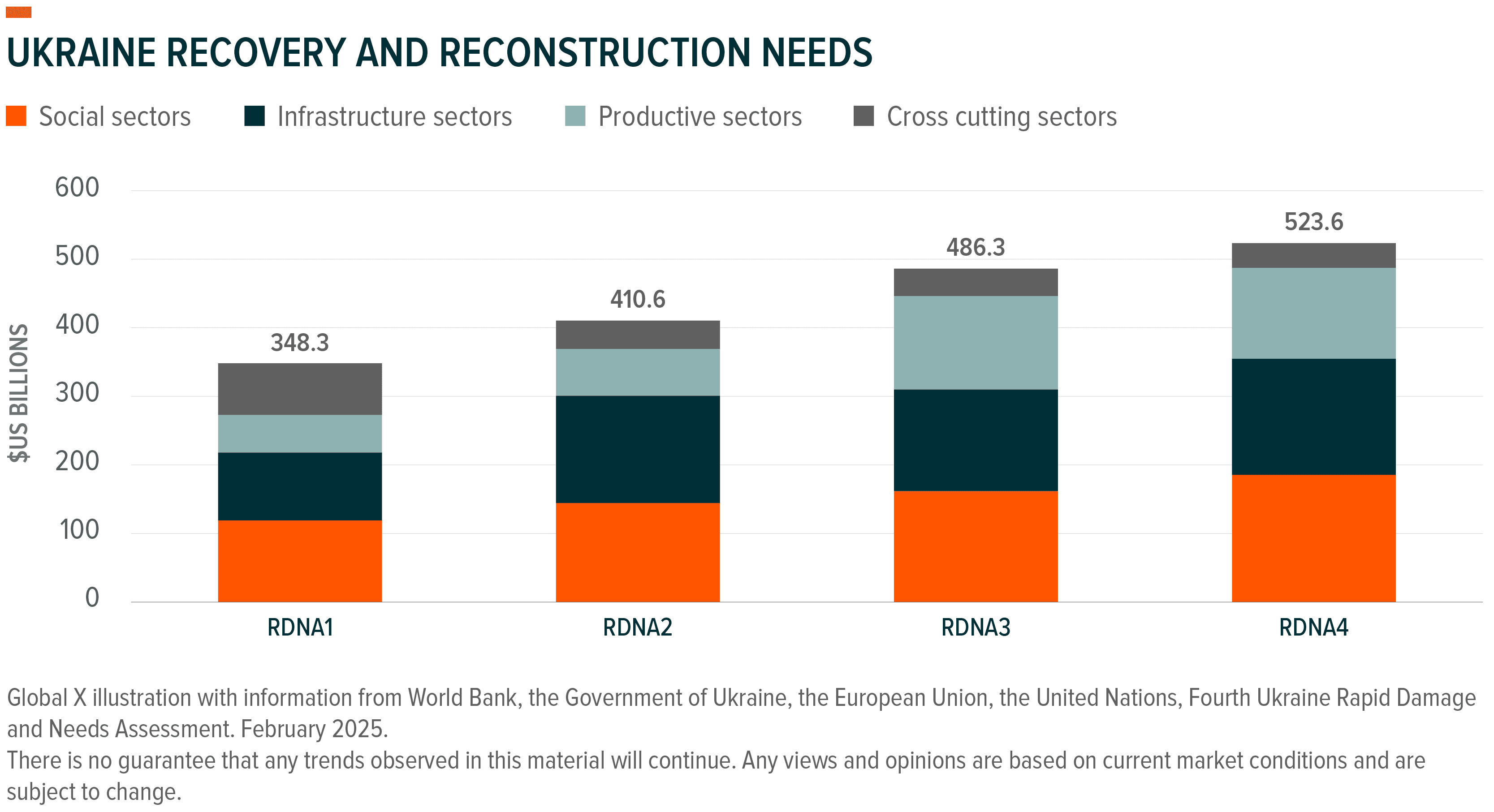

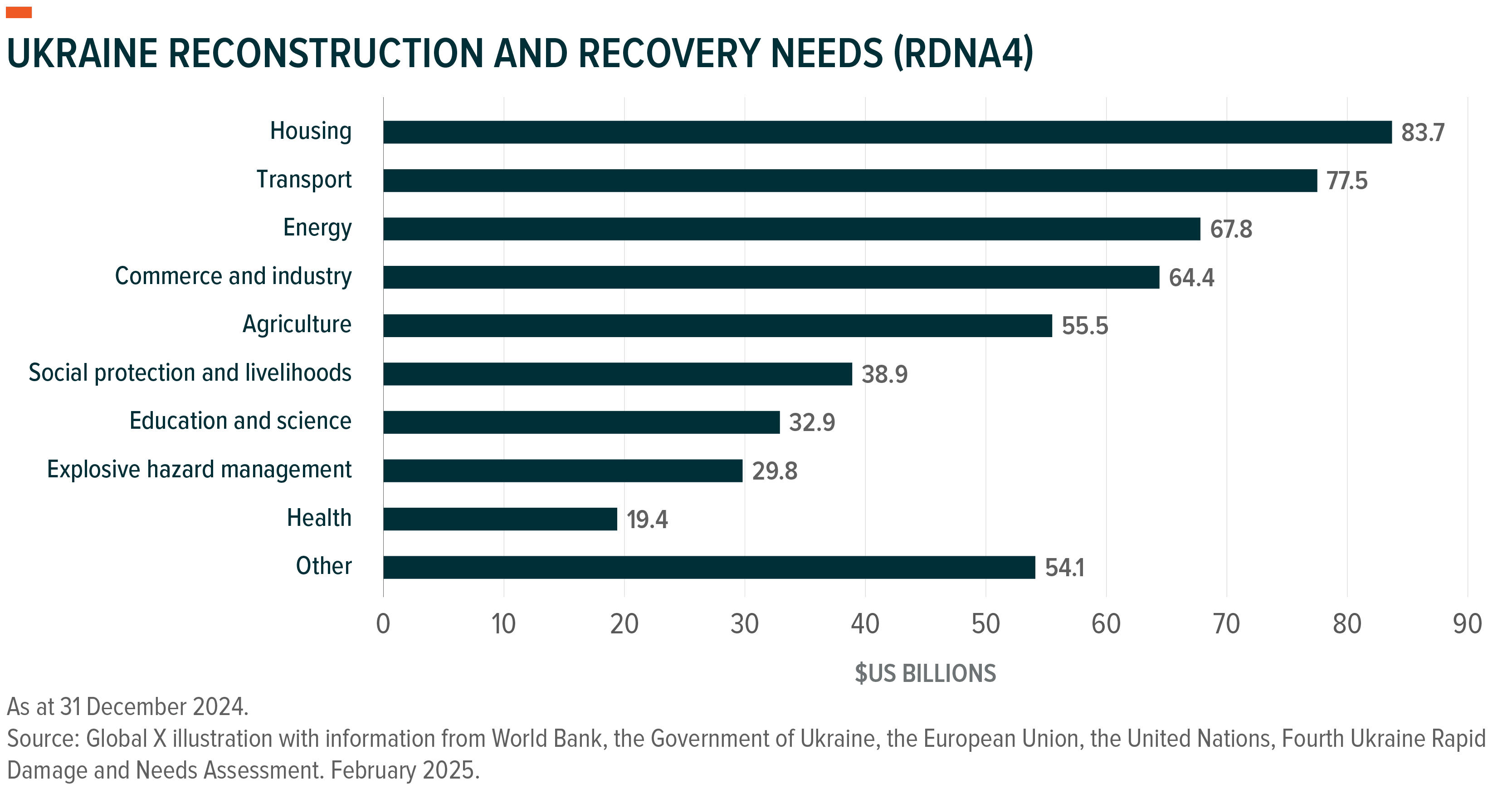

The Fourth Ukraine Rapid Damage and Needs Assessment (RDNA4), commissioned by the Ukrainian Government, the World Bank Group, the European Commission and the United Nations, estimates direct damage in Ukraine at $176 billion as of December 2024, up from $152 billion in December 2023.7 Total costs of reconstruction and recovery in Ukraine over the next decade is estimated at $524 billion, based on damage incurred from February 2022 to December 2024.8 This is $38 billion more than RDNA3,9 reflecting escalating needs. As the conflict continues, both the direct damage and total cost of reconstruction and recovery could continue to increase.

RDNA4 highlights nine priority areas across three categories: (1) Social Sector, (2) Infrastructure Reconstruction and (3) Demining and Civil Protection.10 The Social Sector category emphasises reconstruction and rehabilitation in Housing, Education and Science, Health, and Social Protection and Livelihoods. This adds to the development needs for public utilities highlighted in the Infrastructure Reconstruction category: Energy and Mining, Transport, and Water Supply and Sanitation.11 Infrastructure spans seven of the nine focus areas and is central to Ukraine’s long-term development.

Building Back Better: A Long-Term Infrastructure Development Focus

The Ukraine Government views reconstruction as an “opportunity for transformation”, not just restoration.12 A “building back better” strategy prioritises resilience and sustainability,13 creating long-term opportunities for companies across infrastructure and energy.

Reconstruction efforts are already underway, with RDNA4 identifying $17.32 billion in financing needs in 2025.14 However, secured funding has fallen short, with the Government of Ukraine and donors only able to allocate $7.37 billion.15 Private capital is expected to play an important role in making up this shortfall, with multilateral lenders (IFC, European Bank for Reconstruction and Development, and European Commission) launching initiatives to unlock private financing.16,17,18 Private capital could cover one third of total needs,19 provided reforms enable wider participation.

Which Sectors Could Benefit?

Although companies’ current revenues from Ukraine are an unreliable predictor of their future revenue from Ukraine, given the ongoing conflict, examining companies that are active in Central and Eastern Europe, or those with past projects or current agreements in Ukraine, may offer insights into potential beneficiaries of its reconstruction.

Construction & Infrastructure

European infrastructure development companies could be well-placed to benefit from the reconstruction of Ukraine, with many well-established in Central and Eastern Europe or having completed previous projects in Ukraine. For example, Ferrovial, via its Budimex unit, is a major player in Poland, which accounts for 25% of Ferrovial’s construction backlog.20 As an example of its presence there, as well as its expertise in railway construction, Ferrovial’s Budimex was selected by PKP PLK, the operator of Poland’s railways, to upgrade two sections of Line 7, linking Warsaw and Dorohusk with the Ukrainian border.21 It has also completed numerous other railway projects in Poland, including building Gdańsk metro, modernising Krakow light rail, and upgrading Wrocław station.22 This is particularly relevant as Poland has long been referred to as a hub for the reconstruction of Ukraine, given it shares a long border with Ukraine and has been a long-time supporter of Ukraine.23 Vinci’s role in the €1.5 billion Chernobyl containment arch construction,24 and its €417 million in Czech transport infrastructure contracts,25 highlight deep Central and Eastern European exposure. It also generated over €1 billion revenue in Czechia alone in 2023.26 Acciona’s prior renewable energy projects in Ukraine, (it completed a €55m, 57 MW solar PV plant near Kyiv in 2019) also underscore long-standing engagement.27 Major European contractors have significant global construction and project management experience, and could win contracts to rebuild bridges, roads and power plants.

Defence & Engineering

Defence and engineering companies also have direct Ukraine exposure. Thales has signed agreements to set up joint ventures and maintain Ukraine’s radar, communications and electronic‐warfare systems.28 Leonardo is supplying five radar systems to rebuild Ukraine’s air‐traffic control network, to restore and enhance Ukraine’s civil air navigation infrastructure.29 Palantir has partnered with Ukraine’s Ministry of Economy to support the Ukraine Government’s goal of bringing 80% of potentially contaminated land into productive use within ten years.30 These moves align with the Demining & Civil Protection priority in RDNA4,31 potentially positioning these firms for both reconstruction and defence-related work.

Materials & Equipment

Suppliers of bulk materials, fabricated steel and heavy equipment are the other large potential beneficiaries by virtue of scale. Reconstruction is likely to demand millions of tonnes of aggregates, cement and steel, and sustained access to cranes, earth-moving equipment and other equipment.32 Building materials suppliers, such as materials giant CRH, which recently bought Buzzi’s Ukrainian cement operations,33 as well as products and equipment companies, could be well-positioned to potentially benefit.

Energy Transition

Beyond the initial reconstruction phase, the “building back better” approach could also have large implications on Ukraine’s energy infrastructure.34 The energy sector has been one of the hardest-hit during the conflict, with damages estimated at $20.51 billion as of 31 December 2024, more than doubling in the span of one year.35 Under the EU-backed Ukraine Facility, Ukraine is aligning with EU energy policy, focusing on energy security, renewables, and decarbonisation.36 As an example, Vestas Wind Systems received two orders to supply wind turbines to the largest wind energy project in Ukraine.37 While there are more immediate energy concerns, if Ukraine’s longer-term reconstruction emphasises clean power as policymakers suggest,38 this could potentially benefit not only construction and engineering companies, but also clean energy operators.

Conclusion

Although the conflict’s trajectory remains uncertain, recent diplomatic developments raise the possibility of resolution.39 With $524 billion in reconstruction needs over the next decade, a “build back better” strategy, and broad multilateral support, Ukraine’s reconstruction could offer significant investment opportunities. Across construction and engineering, defence and engineering, building materials, products and equipment and clean energy, companies that are active in Central and Eastern Europe, or those with past projects or current agreements in Ukraine, could be well positioned to potentially benefit from its reconstruction.