Marketing Communication. Capital at Risk. For Professional Investors Only.

The video gaming industry can often be dismissed as a niche investment category, but its scale may tell a different story. In 2024, global spending on video games reached nearly $180 billion, exceeding the combined total spent on professional sports.1,2 Nearly five years after the COVID boom, the sector is receiving renewed attention.3

A wave of major game launches appears to be energising demand, and a new console upgrade cycle is emerging as new titles push the limits of existing hardware.4 AI is transforming gameplay and development, boosting player engagement while helping game publishers and studios accelerate production and improve margins.5 Receding regulatory headwinds in key markets like China are also fuelling momentum for publishers and hardware makers.6 With these forces in play, the global gamer base is expected to surpass 3 billion by 2029, up 17% from 2024.7

Advances in hardware, networks, and gaming applications, along with emerging paradigms like social and cloud gaming, could fuel the industry’s growth flywheel.

There is no guarantee that any trends observed in this material will continue. Any views / opinions are based on current market conditions and are subject to change.

Key Takeaways

Gaming Is a Massive Global Market with a Potential Runway for Growth

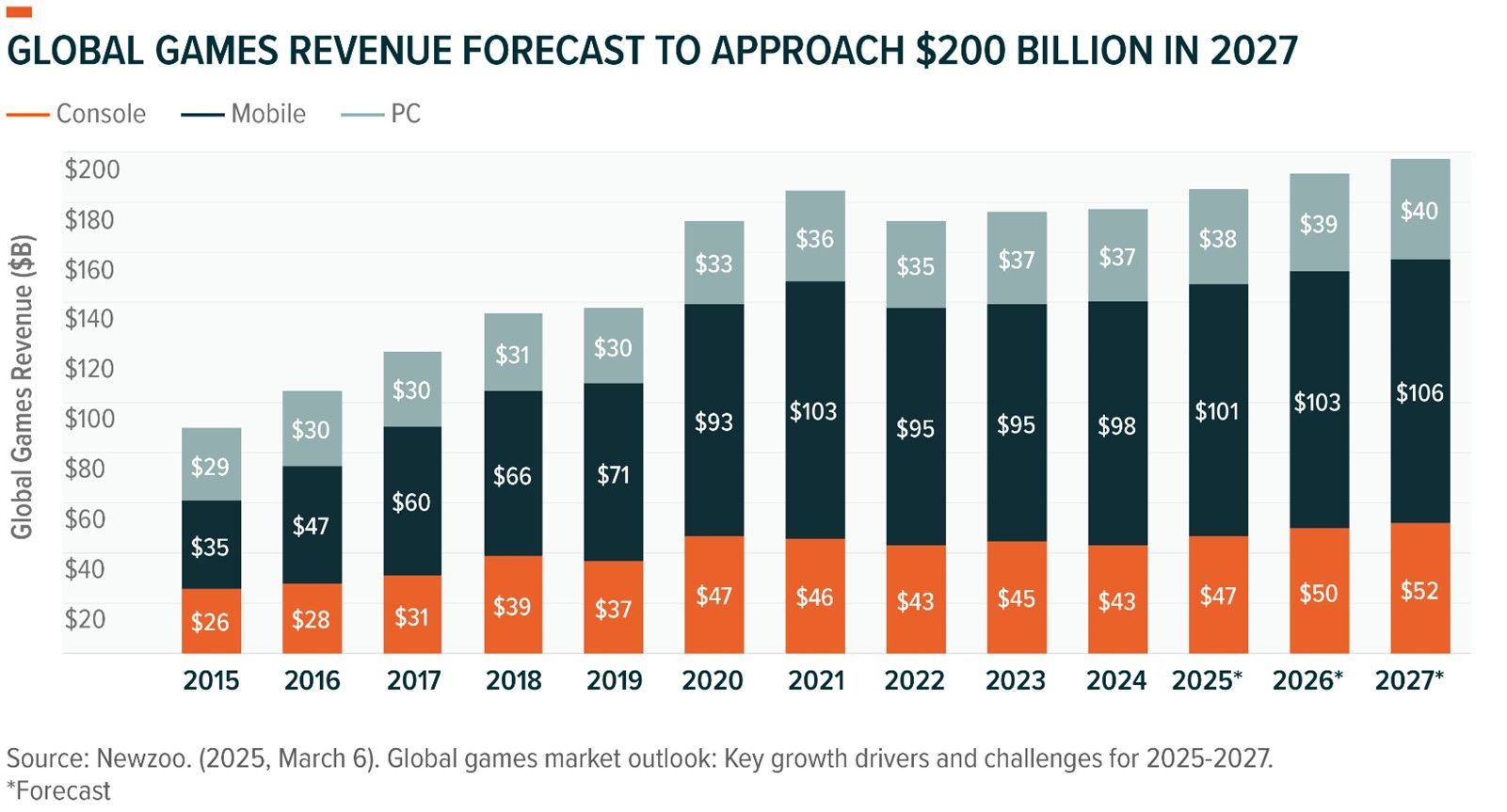

The global video gaming market grew to $178 billion in 2024, surpassing professional sports, with forecasts suggesting it could grow another 11.5% to exceed $198 billion by 2027. 10,11 The scale and the diversity of the market are arguably unparalleled within the entertainment industry. The emergence of new technological tools, such as AI, appears to be creating more opportunities for the industry to reinvest and innovate, particularly to accelerate game development, reduce costs, boost engagement, and improve advertising targeting.12 Similarly, the rise of newer business models, such as subscription-based gaming, as well as newer platforms like mobile and cloud gaming are lowering barriers to entry and broadening access.13 Notably, cloud gaming is expected to grow at a 25% compounded annual growth rate (CAGR), reaching over $25 billion by 2029.14

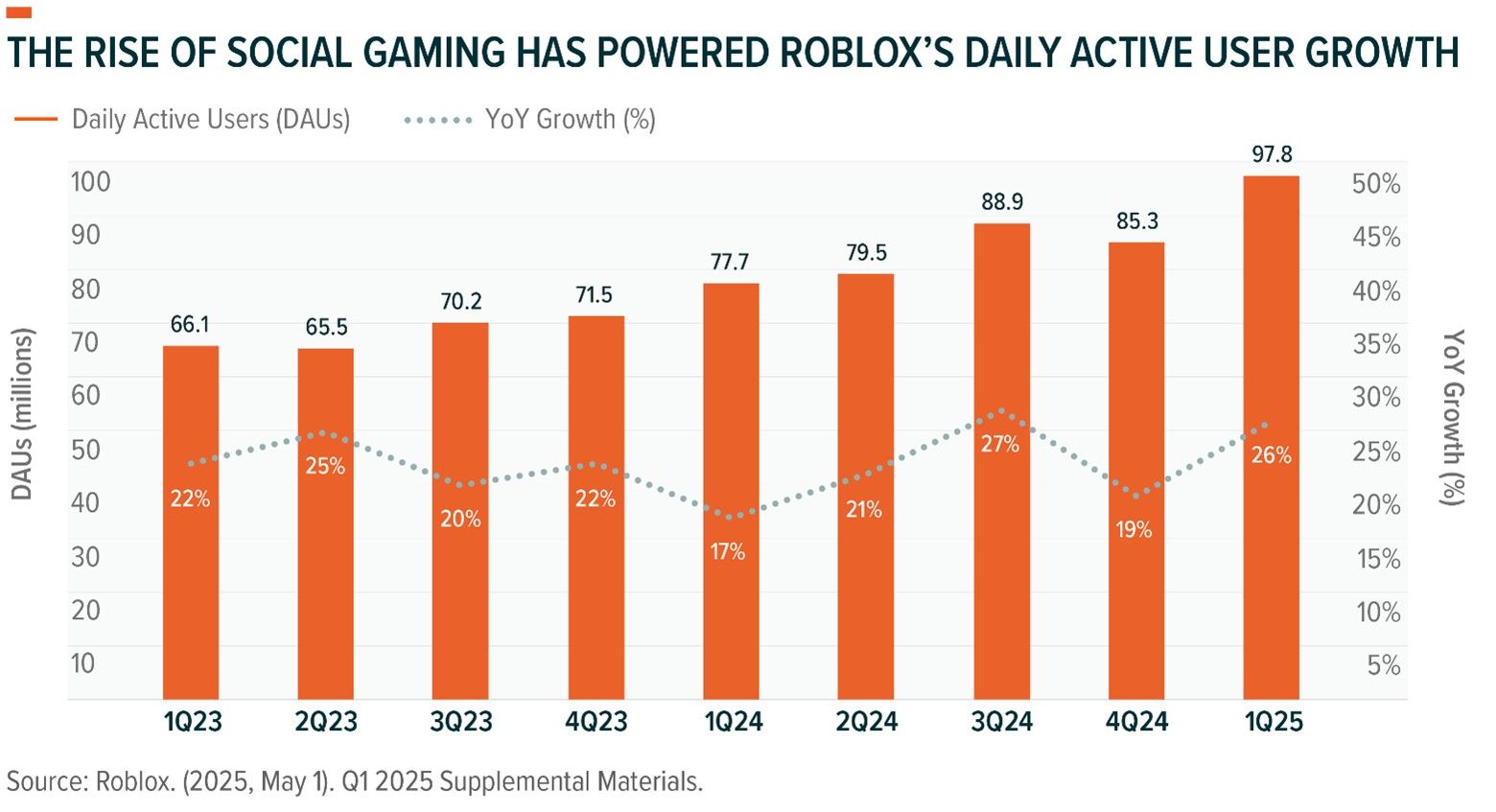

Social gaming is another subsegment displaying impressive growth. Roblox, which generates more than $4 billion in annualised revenues, grew revenues 29% year-on-year (YoY), as shown by the company’s most recent earnings release.15 User engagement remains robust too, with average daily active users climbing 26% YoY to 97.8 million and hours spent on the platform growing 30% YoY.16 These metrics perhaps highlight strong success of social gaming and user-generated content, a subsegment in the gaming space that is becoming increasingly popular with younger games.

There is no guarantee that any trends observed in this material will continue. Any views / opinions are based on current market conditions and are subject to change.

Regional Dynamics Behind Gaming’s Success?

After decades of gradual progress, gaming appears to have gone mainstream in the U.S. Roughly 213 million people play video games for at least 1 hour each week in the U.S. 17 The average gamer spends 12.8 hours gaming per week, a number that is growing quickly as gaming evolves beyond younger generations.18 In 2004, just 17% of Americans aged 50 and older played video games; by 2024, that figure had risen to 29%.19

Similar trends appear to be playing out in markets like China and Japan.20 In China, regulators, who once threatened aggressive restrictions on gaming time for young gamers, appear to have taken a more relaxed stance toward gaming policies, supporting growth.21 Investments in cloud gaming, 5G adoption, and AI-infused functionality could help maintain growth. In 2024, China’s gaming market grew nearly 7.5% YoY to over $44.8 billion, driven by the release of hit games like Justice Mobile from NetEase and continued momentum of Tencent’s Honor of Kings.<sup22

One of the largest gaming companies in Japan, Konami Group, reported fiscal year (FY) 2025 revenue and profit growth of 17% YoY and 26% YoY, respectively, driven by strength across key titles in its Digital Entertainment business and sales of new console game releases.23

Regionally diverse potential growth drivers, from potentially more relaxed regulation in China, to rising engagement among older U.S. gamers, underscores the cultural, policy, and market nuances shaping the gaming ecosystem.24 This complexity may support the theme’s durability, as gaming’s next phase may be defined not just by innovation, but by its integration across geographies, age groups, and platforms.

A Robust New Release Slate and New Hardware Launches Could Catalyse Growth

Major new releases like Call of Duty: Black Ops 6, and Helldivers II have helped top game publishers boost engagement in 2025.25 The sports gaming subtheme has also been performing well, including the EA Sports College Football 25 title. Electronic Arts (EA) had a record year in FY2025, with net bookings totalling $7.35 billion, driven by over $1 billion in net bookings for the EA American football franchise.26

Grand Theft Auto VI trailer shattered records with 475+ million views in its first 24 hours.27 For context, the game’s current version, GTA 5, generated over $8 billion in global revenue, making it the highest-grossing single entertainment product in history, across games, movies, books, and music.28

Helped by new releases potentially triggering hardware upgrades, the console market is estimated to grow 20.9% through 2027, sharply outpacing mobile and PC.29 A hardware refresh cycle appears ready for 2025 and 2026, with Sony and Nintendo making early moves. Perhaps thanks to a strong lineup of exclusive titles, Sony had shipped 77.8 million PlayStation 5 units as of 31 March 2025, closely aligning with the PlayStation 4’s performance at a similar stage in its lifecycle.30 Nintendo’s Switch 2 sold more than 3.5 million units in its first four days after launching in June 2025.31

Historically, hardware sales can be a leading indicator of software and platform success.32 A substantial install base could attract developers and may encourage increased software sales, and overall platform growth. For instance, Sony sold over 160 million PlayStation 2 units, with software sales exceeding 1.5 billion units, while Nintendo sold 101.62 million Wii units and roughly 922 million software units.33, 34

AI Integration Could Create Growth Opportunities Across the Industry

Generative AI is beginning to transform game development, testing, and gameplay by reducing costs and dramatically shortening development times by over 20x in some instances.35 The efficiencies that generative AI offers could not only expand the gaming industry’s total addressable market but also potentially lowers barriers to entry and can even broaden the investment universe.

These factors can potentially support ongoing investment in new content and game development. Smaller publishers and studios may also find opportunities, as advancements in AI tools, such as coding assistants and creative generators, have the potential to improve development efficiency and reduce production costs.36

Have Gaming Fundamentals Strengthened?

Many leading players used the post-COVID market reset to streamline operations by reducing excess, cutting costs, and unlocking efficiencies through AI-driven tools.37 As a result, the sector could be entering its next growth phase on a stronger financial footing, with leaner cost structures and improved scalability.

In parallel, has business model innovation added structural strength to the theme? A key shift here is the growing adoption of Gaming-as-a-Service (GaaS) business models, which enables developers to monetise games long after their release through subscription fees, in-game purchases, and ongoing content updates.38 Unlike traditional one-time game purchases, GaaS enables vendors to grow revenues more nimbly and consistently, even during periods of declining console and new title sales. It also helps game developers to maintain pricing power and supports margin stability.39

Leading gaming companies have also expanded net bookings while containing production costs, largely by securing incremental spending on existing offerings. For example, Take-Two Interactive’s net bookings rose to $5.65 billion in FY 2025 from $3.55 billion in FY 2021, predominantly due to recurrent consumer spending.40 Similarly, Roblox's bookings climbed to $1.2 billion in Q1 2025, up from $774 million in Q1 2023.41

Lastly, gaming has historically demonstrated low sensitivity to economic cycles, with consumers maintaining spending even during slowdowns, which could position the sector as a potential buffer in volatile markets.42

Conclusion: Video Gaming Industry Appears to Be at a Key Inflection Point

The gaming industry appears well positioned for continued momentum. As some consumers could look to trim discretionary spending, digital entertainment remains a sticky and affordable outlet. Meanwhile, the resurgence of key markets like China and Japan could act as a potentially further tailwind. Looking ahead, gaming companies may further harness AI to accelerate development cycles, deepen engagement, and refine advertising strategies, which should help catalyse growth and could well sustain margin improvements throughout this decade.43

1. Newzoo (06/03/2025). Global games market outlook: Key growth drivers and challenges for 2025-2027.

2. SportsPro. (06/05/2025). Global sports industry generated US$170bn revenue in 2024.

3. Bird & Bird (11/02/2025) Horizon Scan 2025: Key Trends in Games & Esports

4. Anotra (24/06/2020) Get ready for a strong console cycle

5. Educational Voice (19/04/2025) AI Economic Impact on Animation: Reshaping Industry Practices and Job Markets

6. China Briefing (22/02/2024) China’s Gaming Industry: Trends and Regulatory Outlook 2024

7. Statista (09/04/2025). Number of video game users worldwide from 2019 to 2029.

8. Newzoo. (06/03/2025). Global games market outlook: Key growth drivers and challenges for 2025-2027.

9. Intellias (26/02/2025) How Generative AI Can Be Used in iGaming

10. Statista (09/04/2025). Number of video game users worldwide from 2019 to 2029.

11. Newzoo (06/03/2025). Global games market outlook: Key growth drivers and challenges for 2025-2027.

12. Intellias (26/02/2025) How Generative AI Can Be Used in iGaming

13. Alix Partners (06/01/2025) Beyond the console: Video gaming’s cloud revolution

14. Statista Marlet Insights (01/2025). Cloud Gaming

15. Roblox Investor Relations (01/05/2025) Roblox Reports First Quarter 2025 Financial Results.

16. IBID

17. Plarium. (23/05/2025). Average Time Spent Playing Video Games per Day + Other Stats and Health Tips.

18. IBID

19. IBID

20. AI Invest (14/05/2025) Tencent’s Gaming Renaissance: Regulatory Lift and Global Ambition Signal a New Era

21. Entertainment Software Association (03/06/2025) Annual ESA Study Reveals Video Games’ Universal Appeal Across Generations

22. SCMP (13/12/2024) China’s video gaming revenue hits new high in 2024 on back of blockbuster releases.

23. RTT News (8/06/2025) Konami Group Corporation Reveals Rise In Full Year Profit.

24. Entertainment Software Association (03/06/2025) Annual ESA Study Reveals Video Games’ Universal Appeal Across Generations

25. FT.com (25/10/2024) Microsoft bets on latest ‘Call of Duty’ to power up video games strategy

26. Electronic Arts (06/05/2025). Electronic Arts Reports Q4 & FY25 Results. Electronic Arts (EA) operates on a March fiscal year-end, meaning each fiscal year runs from April 1 to March 31 of the following calendar year.

27. The Hollywood Reporter (07/05/2025) ‘Grand Theft Auto VI’ Trailer Smashes Past 475 Million Views in First Day (Exclusive).

28. Finance Monthly (07/05/2025) How Much Money Has Grand Theft Auto V Generated?

29. Newzoo (06/03/2025) Global games market outlook: Key growth drivers and challenges for 2025-2027.

30. Video Games Chronicle (14/05/2025) Nearly 5 years in, PS5 sales remain neck-and-neck with PS4.

31. CNBC (11/06/2025) U.S. online stores put ‘out of stock’ signs as Nintendo Switch 2 sales hit record highs.

32. Sage Journals (01/03//2009) The Effect of Superstar Software on Hardware Sales in System Markets

33. Sony (14/02/2011) PlayStation®2 Sales Reach 150 Million Units Worldwide.

34. Nintendo (31/03/2025) Dedicated Video Game Sales Units.

35. Transcend (18/09/2024) The Accelerating Transformation Of Gaming.

36. Research Gate (February 2025) Could AI Make Video Games Cheaper to Produce?

37. Gam3s (18/05/2025) $1.8 Billion Invested Across Five Years

38. Juego Studios (24/06/2025) Everything You Need to Know About: How Studios Are Adapting to Game-As-A-Service Model

39. NoBlue2 (2025) How gaming is evolving to GaaS

40. Take-Two Interactive (May 2025) Investor Presentation. FY 2025 covered April 1, 2024 - March 31, 2025.

41. Roblox (01/05/2025) Q1 2025 Supplemental Materials.

42. AdTonos. (04/09/2024) The gaming industry, a resilient hub of innovation and growth.

43. Adjust (16/04/2025) AI in mobile gaming: Creating smarter worlds and stronger engagement